Exciting Stocks Are Not Always the Best Investments

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

As 2023 was the year of the Magnificent Seven (1) – a small group of tech stocks that captivated the media with their eye-popping returns – investors are questioning whether that performance will continue. They might also fear that they could be missing out by not allocating more of their portfolio to those high-performing stocks.

First, let’s consider what sparked the strong performance. At the start of 2023, the term Magnificent Seven didn’t exist, at least not related to stocks, but by the end of the year, the moniker was dominating headlines as the returns for this small group of companies began to soar. (2) Most of them benefited from the buzz created by OpenAI’s ChatGPT model and stories about how artificial intelligence (AI) could reshape the way the world does business. Investors felt these stocks could be best poised for growth from the new technology.

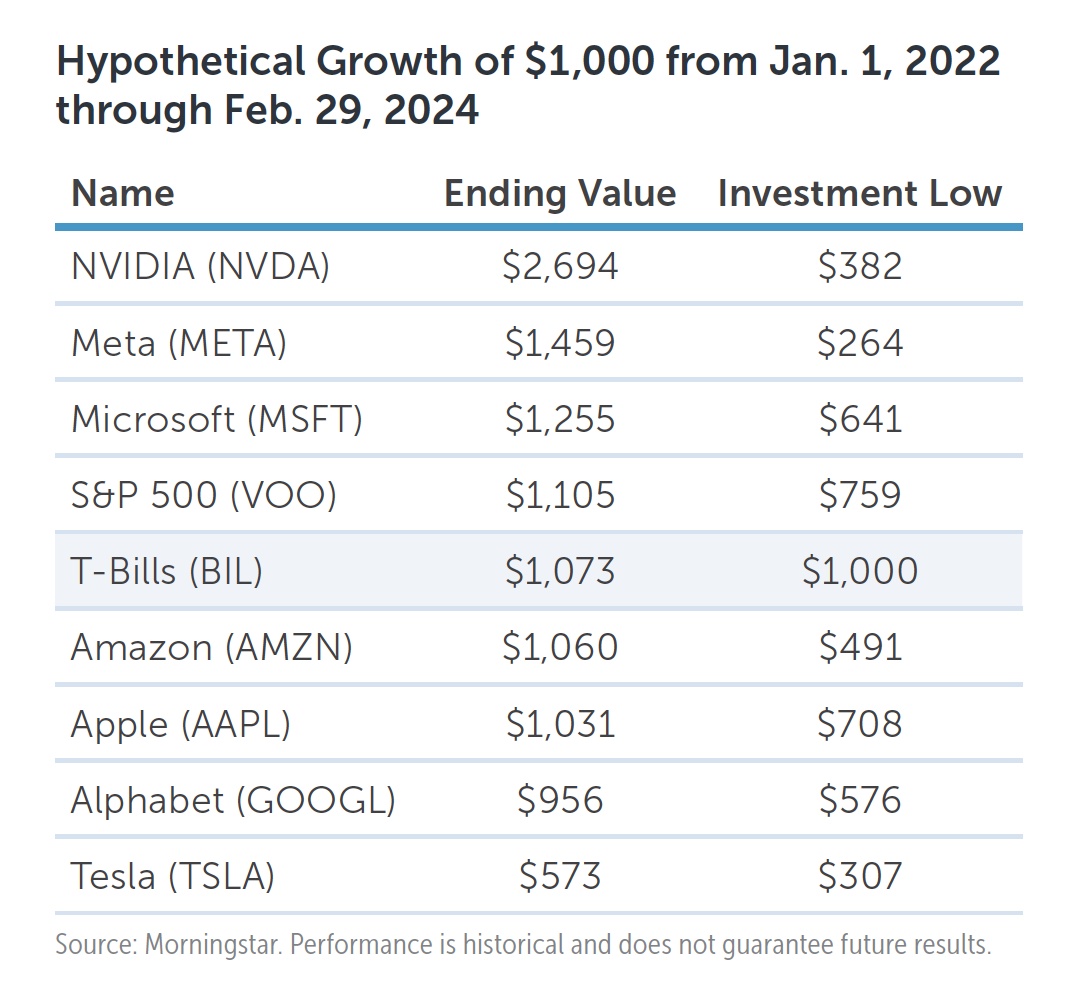

But the Magnificent Seven also benefited from another tailwind: along with the broader stock market, they were recovering from sharp price declines in 2022. On average, the Magnificent Seven stocks fell 46% in 2022 compared to just an 18% decline for the S&P 500. NVIDIA at one point lost over 60% of its value; Meta lost over 70%. In fact, over half of the Magnificent Seven companies haven’t even outperformed risk-free Treasury bills since January 2022.

This highlights a key challenge of investing in stocks: good companies don’t necessarily make good investments. That’s because every company is worth its value today (which we can measure) plus some story about how much money it will earn in the future. And every company is priced based on how believable people find that story. As stories change, or as people lose faith or gain conviction in the story, we see swings in the stock prices of the underlying companies.

Although the Magnificent Seven companies may emerge as the leaders in the AI space, we believe most investors are better served by investing across many companies in a variety of industries. In other words, while we want to own these companies, we don’t want to own only these companies. That’s because it’s difficult for the same companies to keep outperforming over the long term, and it’s a gamble for investors to try to predict which ones will.