Protecting Your Portfolio in a Presidential Election Year

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

The 2024 presidential election is set to be a repeat of the Biden versus Trump contest of 2020 (deep sigh).

With both houses of Congress up for grabs, the stakes are high for either party, so it is understandable for the U.S. public to be nervous. Regardless of how the election plays out, political tensions will likely remain elevated throughout the next president’s term, adding to an already contentious global political climate. Against this backdrop, many investors are anxious about the possible impact on financial markets.

Here’s what to keep in mind this election season:

Geopolitical risks are already priced into markets.

For financial markets, geopolitical risk is not new. While there have certainly been periods when geopolitical risks were perceived to be more elevated, global markets are continuously pricing in these risks.

For as long as markets have existed, stock prices have endured the risk of world wars, regional conflicts, revolutions and countless other geopolitical events. The historical record helps investors understand the risk in most traditional stock and bond allocations. However, it’s still possible that new events may reshape the historical record.

When investors begin to worry that political risks are rising, we encourage them to think through this question: Setting aside the upcoming election, are you comfortable with the historical risks that your allocation has exhibited? If you aren’t sure, a good first step is speaking with your financial planner to better understand the historical risk profile of your asset allocation. This can help you decide whether you are exposed to more risk than you’re comfortable taking.

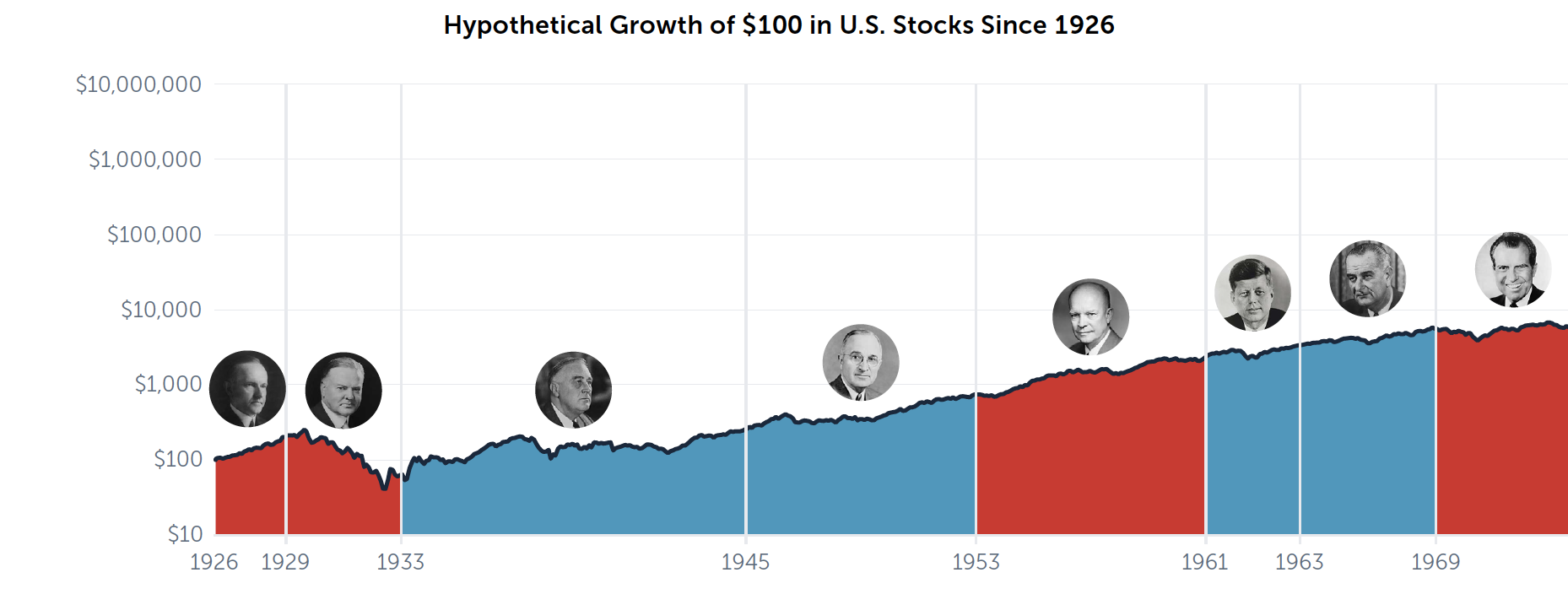

Election outcomes have little impact on stock markets, and the U.S. economy is better poised to withstand a global slowdown compared to other economies. For the U.S. stock market, there is abundant evidence that the outcome of a presidential election has not systematically impacted the market one way or the other. What matters more are the federal policies pursued during the next administration’s term. However, just like with geopolitical risks, the markets price in how such policies could impact economic growth, inflation and other indicators.

Regardless of who’s in power, we believe the biggest long-term economic challenge for future administrations is the U.S. government’s growing size, both from a fiscal and regulatory perspective. With both parties divided on how to address the government’s growing debt, this will likely lead to slower global economic growth. Keep in mind, however, that the U.S. economy is much better positioned than virtually all other developed governments and should still be more resilient to fiscal risks compared to most economies.

Investors benefit from favorable stock market pricing conditions.

While we covered how markets price in a range of political and economic risks, investors should also consider how a company’s stock price compares to the earnings it generates. Across most asset classes, the news is positive. Although U.S. stock market valuations are above their longterm averages, most other broad asset classes — including the U.S. bond market, global developed stock markets and emerging stock markets — are relatively close to historical valuation levels.

Even for the U.S. stock market, while large-cap stocks are mostly above their historical valuation levels, smaller and more value-oriented companies have valuation levels closer to their historical averages. This leads to our final point: the importance of diversifying and avoiding the temptation to chase the investments with the highest recent returns.

Diversification is your friend – especially during uncertain times.

While elections have the potential to reshape policies and legislation, it’s difficult to predict which sectors or industries could benefit. The most effective way to manage risk, whether geopolitical or otherwise, is broad diversification.

In the current environment, U.S. large-cap stocks have made a comeback after struggling in 2022. Because of that recent strong performance, some investors may be tempted to lower their allocation to other types of stocks, like foreign stocks and smaller company stocks. The outcome of the election will not influence whether these trends for stocks continue, and no one can successfully predict which stocks will outperform over the next year.

That’s why we believe investors should maintain their allocations across global stock markets, as well as to high-quality bonds with relatively short maturities. They might also consider some allocation to inflation-protected Treasury bonds. Finally, depending on their risk profile, some investors may want to consider allocating to alternative investment strategies. While alternatives may not be appropriate for all investors due to their complexity, some strategies are less exposed to geopolitical risks than broad stock and bond markets.

If you still feel concerned about how the 2024 election could impact your portfolio, speak to your financial planner about lowering your risk exposure and making sure your portfolio is well diversified.

It doesn’t hurt to take a break from following the election coverage either!