Q1 Market Commentary: A Look Back & Ahead

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

As evidence-based investors, we use an approach fueled by data with over 50 years of research, rooted in diversification and tax conscious investment options. Time has proven the value of investing. While these quarterly market reviews are helpful for staying informed, we also love to remind our clients and community: focus on what you can control, remember the big picture, and stick to your plan.

market snapshot:

Global stock markets, led by large, tech-oriented firms in the U.S., continued their climb. Valuations for the Magnificent Seven stocks have risen fast, but fortunately the rest of the market has valuations much closer to their historical averages.*

Bond markets have remained resilient. Bond spreads, or the additional interest a company must pay above a similar Treasury bond, have tightened considerably for higher rated U.S. companies, helping to buoy company balance sheets.

ECONOMIC MOMENTUM CONTINUES

Main Takeaway

Although markets had a strong first quarter, inflation has been stickier in some key areas of the economy. The services industry continues to be resilient, with employment rising and inflationary pressures increasing, while more interest rate sensitive areas, such as manufacturing, are weaker. The optimistic tone from the Fed has improved the outlook for interest rate cuts, though less liquidity in the banking industry, plus continued fiscal deficits, may keep rates higher for longer.

Top Risks

Rising geopolitical tensions and rate cut predictions have been the main themes this presidential election year. Low office occupancy rates have renewed concerns about the banking sector’s stability, contributing to tighter lending conditions. Municipal finances are coming under pressure in large cities. Government debt levels in most developed nations and China are at all-time highs. Inflationary pressures in the services sector could keep inflation above the Fed’s 2% target for some time.

Sources of Stability

While the Fed’s battle against inflation may not be over, it has made some progress in interest rate sensitive areas of the economy. House prices have stabilized and show signs of rebounding, and businesses are still increasing wages, suggesting a strong economic undercurrent. The S&P 500 has continued its upward climb, credit spreads have tightened, and IPO and M&A activity have picked up. The likelihood of a recession has fallen, barring an unexpected event.

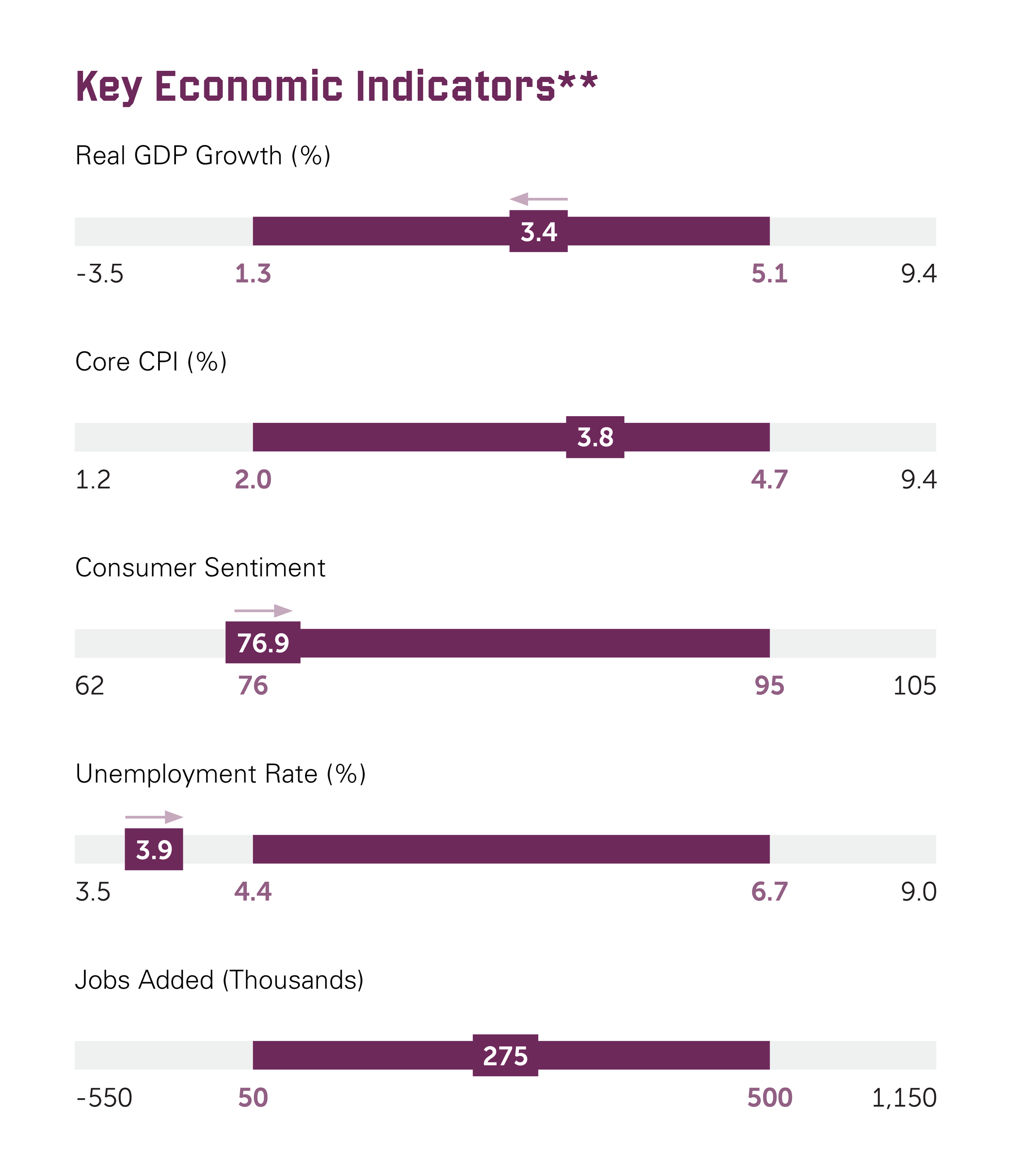

KEY ECONOMIC INDICATORS: AREAS TO WATCH

Economic Growth

We continue to have a bifurcated economy, with interest-sensitive sectors in or close to a recession at the same time that we have a strong services sector. The Philly Fed’s first-quarter 2024 survey4 projected that real U.S. GDP will grow 2.4% in 2024, up 0.7 percentage points from the estimate in the previous survey. The current forecast does not include a single quarter of negative economic growth in 2024. America is the only large economy back to its pre-pandemic growth trend. (5)

Inflation Trajectory

In its March meeting, Fed officials said that inflation is still too high, though they maintained their expectation to cut rates three times in 2024. (6) Through February, headline CPI increased 3.2% on a year-over-year basis, up from 3.1% in January. (7) Core CPI (which excludes the more volatile food and energy sectors) grew 3.8%. The service sector is experiencing inflation pressures. Costs for auto and home insurance and home repairs have risen rapidly over the past year. (8)

Monetary Policy

The Fed chose not to cut rates in the first quarter but left open the possibility of rate cuts throughout the year. With a growing fiscal deficit, a shrinking pool of international buyers of Treasuries, and a trend toward onshoring more production (in some cases for national security), we see risk the Fed may need to keep rates higher for longer than the market is currently pricing. In addition, since September 2022, the Fed has been running down its balance sheet holdings by $95 billion per month. (9) The ability of the markets to absorb all that debt could be challenging.

Fiscal Policy

With the Congressional Budget Office forecasting a $1.66 trillion deficit (10) and a record $8.9 trillion of government debt maturing over the next year, the Treasury will have to find buyers of more than $10 trillion (11) in U.S. government bonds in 2024—more than one-third of U.S. government debt outstanding and more than one-third of U.S. GDP. Research shows that, if debt levels are not addressed, they can be a drag on economic growth once the debt-to-GDP reaches 70%-90% or higher. The U.S. is close to 100%, posing a risk to future economic growth. (12)

Commercial Real Estate

Apollo’s Torsten Sløk noted that office occupancy rates around the country are around 50%, as the hybrid work model is here to stay. (13) As a result, office valuations have fallen, with a 40% decline in the price per square foot for office space. There were 635 U.S. commercial real estate foreclosures in January, up 17% from the previous month and roughly twice as many as in January 2023. (14) This poses a challenge for banks, particularly as small banks account for almost 70% of all commercial real estate loans outstanding. (15)

Consumer Lending

Credit card delinquencies rose more than 50% in 2023, while auto loan delinquencies reached 7.7% in the fourth quarter of 2023, their highest level in 13 years. (16) Bank balance sheets are still recovering from the rate increases of 2022 with $684 billion in unrealized losses for Treasuries and mortgages, roughly 30% of the bank equity capital, forcing banks to be more selective with their loans. Meanwhile, the housing market has started to rebound. Home sales rose 9.5% in February and prices rose 5.7% from a year earlier. (17)

Global Economy

The U.S. is not the only country facing problems related to rising debt-to-GDP ratios. Since 2010, debt-to-GDP has increased in all G7 countries except Germany (the U.K., Canada, France, the U.S., Italy, and Japan), pushing each to a debt-to-GDP ratio near to or over 100%. (18) The U.K. is now technically in a recession. The rising debt problem is compounded by Europe’s need to significantly increase defense spending due to the ongoing war in Ukraine.

Municipality Health

The decline in commercial real estate valuations is likely to lead to budgetary problems for some large municipalities. Lower valuations for commercial real estate will lead to lower property taxes on those buildings, which municipalities rely on for their spending. This, combined with higher spending related to illegal immigration for some cities and a flight of high-income individuals and companies from high tax states, will put pressure on municipal budgets and could lead to downgrades of municipal bond issuers.

Thanks to our reliance on long-term evidence-based investing principals, we know that short term data is too noisy to determine our investing choices. Yet, we always like to offer our review of markets because we believe this information should be accessible to all!