FROM OUR INVESTMENT COMMITTEE: Q1 2023 in Perspective

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

During the first quarter, global stock and bond markets continued their upward trends from the previous quarter. The S&P 500 index, a popular headline stock market index in the U.S., started off the year with strong performance and was able to stay in positive territory to end the quarter after shrugging off some late-period volatility caused by fallout from the collapse of Silicon Valley Bank. Bond markets also benefited from a flight to quality when yields plunged, as investors sought refuge while assessing market impacts from the banking sector turmoil both at home and abroad. The result was positive performance for the quarter across most major asset classes.

Source: Morningstar Direct, April 2023. Market segment (Index representation) as follows: U.S. Large-Cap Stocks (Russell 1000 Index), U.S. Value Stocks (Russell 1000 Value Index), U.S. Small-Cap Stocks (Russell 2000 Index), U.S. REIT Stocks (Dow Jones U.S. Select REIT Index), International Value Stocks (MSCI World Ex USA Value Index (net div.)), International Small-Cap Stocks (MSCI World Ex USA Small Index (net div.)), Emerging Markets Value Stocks (MSCI Emerging Markets IMI Value Index (net div)), U.S. Short-Term Bonds (ICE BofA 1-3Y US Corp&Govt TR), Global Bonds (FTSE WGBI 1-5 Yr Hdg USD).

For the quarter, U.S. stocks (as measured by the Russell 3000 Index) gained 7.2%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. IMI Index) gained 7.6%. Emerging market stocks (as measured by the MSCI Emerging Markets IMI Index) gained 3.9%.

The U.S. Dollar Index, a measure of the value of the U.S. dollar relative to a basket of foreign currencies, decreased during the quarter by 1.0%. Over the past 12 months, the U.S. dollar increased by 4.3%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors.

U.S. interest rates increased during the quarter as the Federal Reserve raised the target range of the federal funds rate from 4.25%-4.50% to 4.75%-5.00% with two 0.25% rate hikes in February and March. Markets are pricing in expectations for a 0.25% rate cut, the first since early 2020, at the Fed’s September meeting and for the target range to be set at 4.00%-4.25% by year’s end.

U.S. Economic Review

The final reading for fourth-quarter annualized GDP growth of 2.6% showed an expansion of economic output but at a slower pace than the prior quarter. The unemployment rate inched up by 0.1% from the end of last quarter to 3.6% through February. This coincides with a tight labor market; there were approximately 9.9 million job openings for 5.9 million unemployed workers at the end of February. Domestic inflation showed a reading of 4.6% in February as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE), remained well above the Fed’s long-term target average of 2.0%. Headline inflation, as measured by the Consumer Price Index (CPI), closed out February with a reading of 6.0%. These readings tend to differ primarily because CPI includes volatile categories like food and energy in its methodology while core PCE does not.

Financial Markets Review

Domestically, all size and style equity categories were up during the quarter. International developed stock markets also posted positive performance. For U.S. investors, international stock returns were positively impacted during the quarter by the weakening U.S. dollar. U.S. large-cap stocks were the best performing equity asset class, and U.S. value stocks were the worst performing equity asset class during the quarter. Signs of easing inflation and the potential for future interest rate cuts likely led to positive returns for U.S. and global bonds.

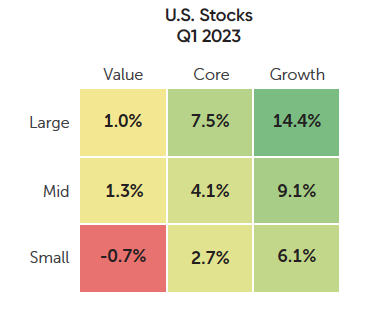

In the U.S., small-cap stocks lagged large-cap stocks across all equity styles. Value stocks lagged growth stocks in all size categories. Among the nine style boxes, large-cap growth stocks performed the best and small-cap value stocks had the lowest return during the quarter.

Source: Morningstar Direct, April 2023. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth, Mid: Russell Mid Cap, Value, and Growth, Small: Russell 2000, Value, and Growth).

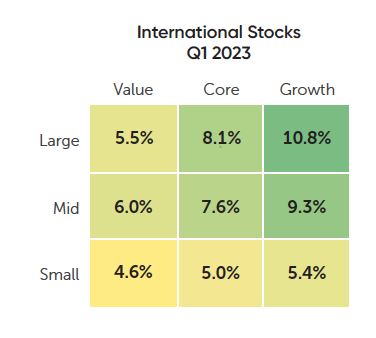

In developed international markets, large-cap stocks outpaced small-cap stocks in all style categories for the quarter. Value stocks lagged growth stocks in all size categories. Among the nine style boxes, large-cap growth stocks performed the best and small-cap value stocks had the lowest return during the quarter.

A diversified index mix of 60% stocks and 40% bonds would have gained 4.5% during the quarter.

Source: Morningstar Direct, April 2023. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value and Growth, Mid: MSCI World Ex USA Mid, Value, and Growth, Small: MSCI World Ex USA Small, Value, and Growth).