WALL STREET JOURNAL: An Engaged Couple Looks To Clean Up Their Finances—An Adviser Tells Them How

This article was written by lisa ward and was originally printed in the wall street journal on SEPTEMBER 12, 2022. Here’s an excerpt, and you can read the full article here (HEADS UP: THERE IS A paywall).

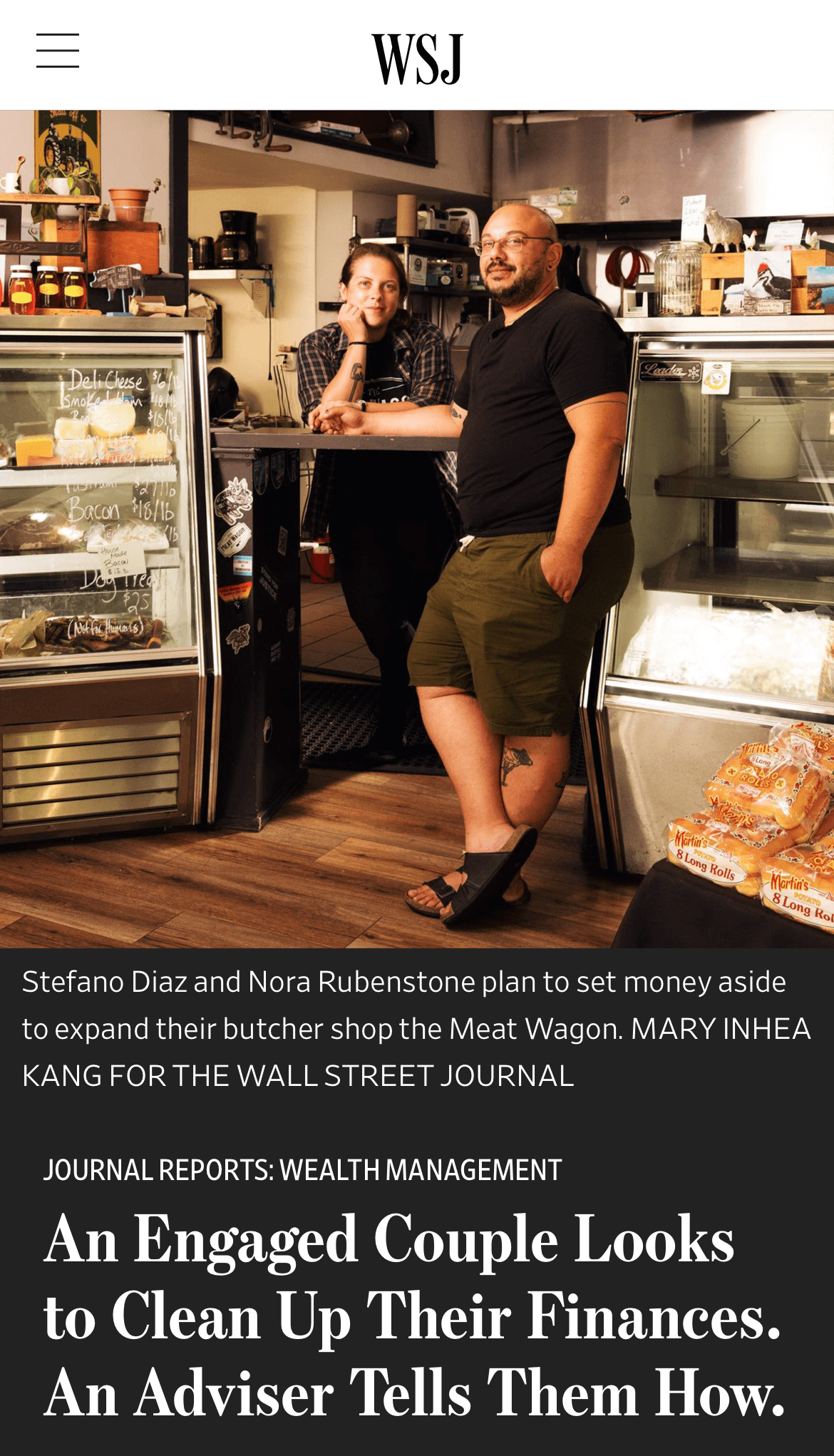

Stefano Diaz and Nora Rubenstone are eager to start their lives together on solid financial footing. The engaged couple in Kingston, N.Y., would like to pay off debt and start setting aside money to invest in their business, renovate their home and, eventually, start a family.

Ms. Rubenstone, who is 33 years old, earns about $50,000 a year as a stage manager for a college theater. Mr. Diaz, also 33, earns roughly $34,000 a year from the Meat Wagon, the butcher shop he owns.

Mr. Diaz has three 401(k) accounts from previous employers, and Ms. Rubenstone has about $1,500 in an investment account, where she owns individual stocks.

They purchased a home in March and have a 4.1% fixed-rate mortgage on which they owe $230,000 and pay $300 monthly for a car loan of about $11,800.

Ms. Rubenstone has $66,500 in student debt—$1,163 of which is a private loan with a $52 a month payment, though she often pays an extra $98 a month. The rest consists of federal loans, which currently are in forbearance because of the pandemic.

Mr. Diaz is carrying balances on three credit cards: $4,700 at an interest rate of 24%, $500 at a 22% rate, and $4,300 at 18%.

Advice from a pro

Georgia Lee Hussey, a certified financial planner at Modernist Financial, in Portland, OR, recommends the couple build up their savings and try to pay down their debt at the same time.

To get started, the couple needs to track all expenses on their debit and credit cards to find areas to cut spending. Then they should create a budget and automate monthly deposits of their savings into a separate account designated as an emergency fund. The extra amounts the couple is paying for the private student loan and the mortgage should go into the emergency fund, too, as should the $20 a month she had been using for buying stocks.

“A lot of couples get excited about paying down their debt,” Ms. Hussey says, “but then get derailed by the unexpected.” Ms. Hussey recommends they set aside at least $200 monthly until they have three to six months of expenses covered, between $12,000 and $24,000.

The couple also should focus on paying down credit-card debt. Mr. Diaz is currently paying about $650 and $750 a month on his three personal cards. If he can consolidate his credit-card debt onto a single card that charges no interest for the first 18 months, he should be able to pay off the full balance.

If he is unable to consolidate his debt, he should pay the minimum balance on all three cards, approximately $600, and then use the remainder of the money to pay off the card with the highest interest rate.

Ms. Hussey says that Ms. Rubenstone should keep her federal student loans in forbearance through the end of December, when the pandemic-inspired pause is set to end. Meanwhile, she should apply for loan forgiveness under President Biden’s new plan, which could help her wipe out at least $10,000 worth of student loans.

Since she works for a nonprofit college, Ms. Rubenstone should also check if she qualifies for the federal public-service loan forgiveness program. If she doesn’t qualify, Ms. Hussey recommends Ms. Rubenstone try to qualify for the recently announced income-driven repayment plan, which could limit payments to 5% of discretionary income and forgive her debt after 20 years.

Meanwhile, the couple shouldn’t neglect retirement plans. Ms. Rubenstone should set up a 401(k) through her job, allowing her to reduce her taxable salary and get a matching contribution from her employer. Growth of the investments is tax free, although withdrawals will be taxed as income. Mr. Diaz should open up a Roth individual retirement account and contribute at least $50 a month. A Roth IRA is funded with after-tax dollars, but growth and qualified withdrawals are not taxed. Mr. Diaz might also want to consider combining his three 401(k)s into a single account so the money is easier to track.

Ms. Hussey says Mr. Diaz should join local business groups and look into government programs designed to help small-business owners.

Finally, the financial planner recommends that as the couple plans for their wedding they keep their financial goals in mind. So, for example, instead of asking for wedding gifts, they might ask for contributions to help them build up their reserves.