Markets (And Some Premiums) Bounce Back

What a difference a few months can make! A few months at the end of 2018 turned U.S. stock returns negative and made international stocks to decline further for the year. Now, just a few months after that recent low, stocks in the U.S. and abroad have staged a significant recovery.

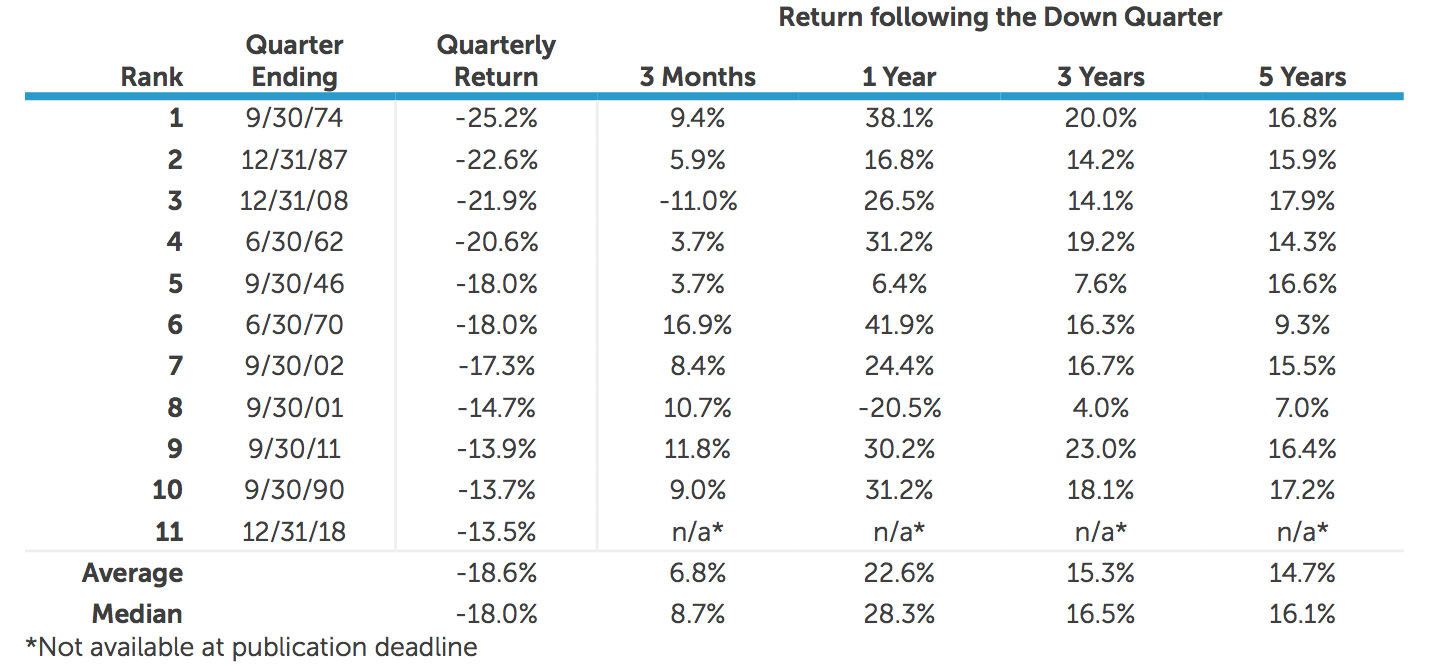

U.S. stocks (represented by the S&P 500 Index) declined -13.5% in the fourth quarter of 2018. After the first two months in 2019, they were up 11.5%. This pattern of losses followed by gains is not a new one and has historically occurred quite often. A review of the following table can help shed some light on this historical pattern.

In the table we list, by order of magnitude, the largest calendar quarter declines in the U.S. stock market since the end of World War II. (The end of World War II is often used as a starting point because the Federal Reserve had its current mandate and tool kit in place by then.) Next to each return we show the subsequent market returns for the following quarter, 1-, 3- and 5-year periods. You can see that the worst quarterly decline of -25.2% occurred in the third quarter of 1974, and the Q4 2018 decline was the 11th worst since 1945.

When we look at how markets performed following those large quarterly declines, we can see that returns were positive in the following quarter in all cases but one. The same is true for the one-year period. In the three- and five-year periods, all the subsequent returns were positive, and the average return was much higher than the long-term historical U.S. market average.

WHAT HAPPENS AFTER A DOWN QUARTER?

A Review of the worst Quarters from the S&P 500 (1945-2018)

While this historical evidence is quite compelling, it is important to remember that there is still risk when it comes to investing. Just because we bounced back from this recent decline, doesn’t mean that we will bounce back from the next one. Yet, our expectation for stocks to post long-term, positive results still holds, and the reality is that those results don’t occur in a straight line.

Small-Cap Premium Bounces Back

While we saw U.S. and non-U.S. stocks recover following the fourth quarter sell off, we also saw a promising trend for our investment strategy. Our academic, evidence-based approach to investing has us focused on factors of return that we feel help drive overall market results. Those factors of return suggest we tilt our investments toward stocks that are smaller than the broad market, cheaper than the broad market, and more profitable than comparable companies.

The historical evidence strongly favors these factors of return, yet they are not guaranteed. Over the past five years, the premiums were not realized. Consider the small company factor of return where we expect small companies to outperform large companies. Over the past five years ending December 31, 2018, small company stocks (measured by the Russell 2000 Index) returned 4.4%, and large company stocks (measured by the Russell 1000 Index) returned 8.2% on an annualized basis. Our expectations for outperformance were not met.

Despite underperforming over the past five years, we still feel small companies should outperform large companies over the long term. That outperformance can occur over very brief time periods and with substantial magnitude. During the first two months of the first quarter, U.S. small company stocks outpaced U.S. large company stocks by a wide margin. U.S. small stocks returned 17.0%, and U.S. large stocks returned 12.0%. Premium can be received in a short period of time, so we feel it is best to stay exposed to small company stocks. If we miss the brief time period premiums appear, it could be detrimental to our wealth.

Takeaways

Our first takeaway is that, uncertainty is a normal part of investing. We don’t know when the stock or bond market may fall, how long it may decline and when it may recover, if at all. Second, despite not knowing when declines may happen and if we will recover from those declines, history has shown us that we should not lose faith in stocks when they decline. Positive results have historically followed most past declines.

Finally, there are risks associated with pursuing the factors of return offered by small-cap companies, value companies and higher profitability companies. These factors may not deliver on our expectations of outperformance over short and medium time frames, but when factor returns do deliver, they can deliver in a big way. Therefore, it is important to stay the course with an evidence-based investment strategy. We don’t want to miss out on the times when the premiums are present.