Q4 Market Commentary: A Look Back & Ahead

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

As evidence-based investors, we use an approach fueled by data with over 50 years of research, rooted in diversification, and tax conscious investment options. Time has proven the value of investing. While these quarterly market reviews are helpful for staying informed, we also love to remind our clients and community: focus on what you can control, remember the big picture, and stick to your plan.

market snapshot

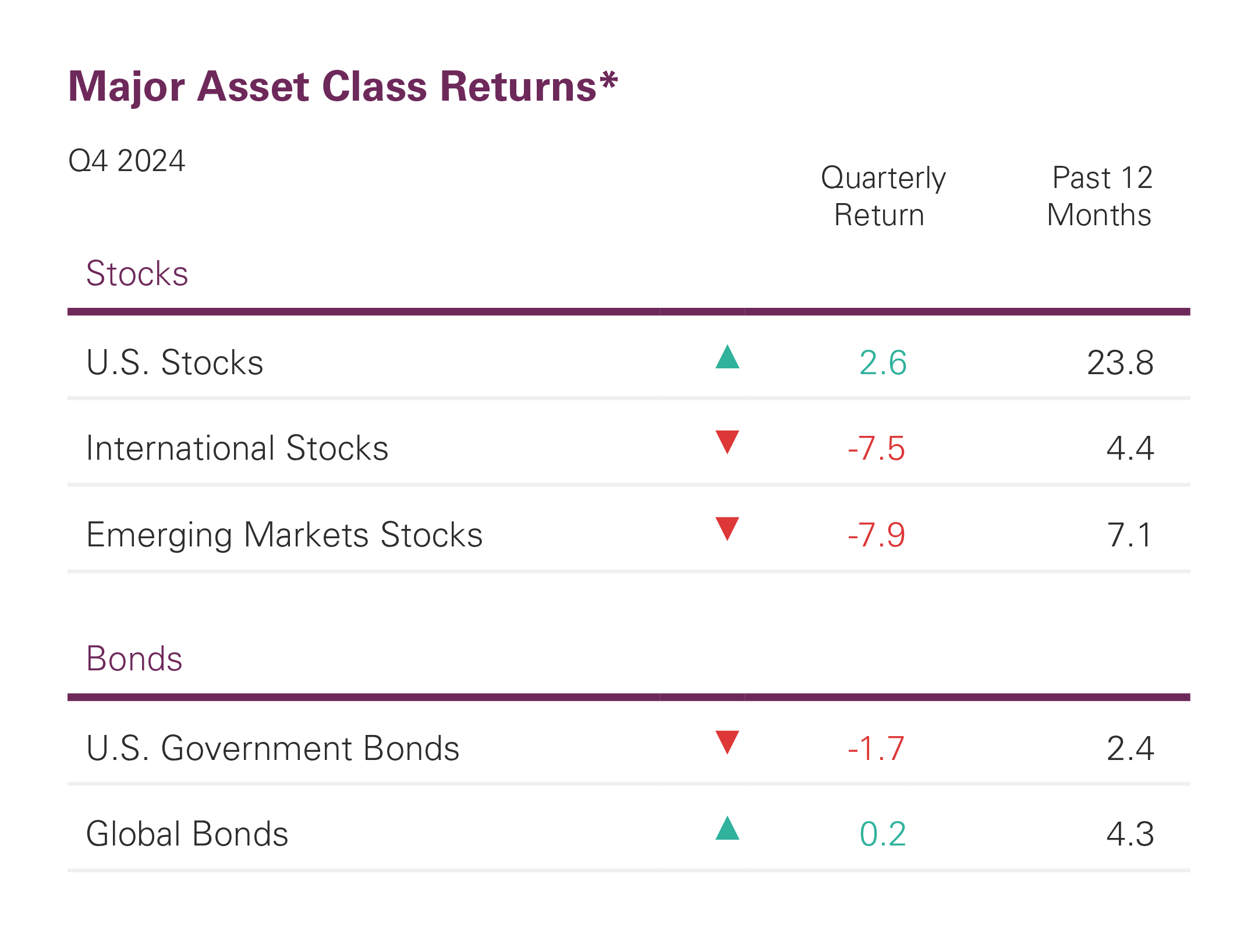

Global equity markets were a mixed bag in the fourth quarter with U.S. markets producing modest returns while international stocks were down sharply. Small value lagged over the quarter both domestically and internationally, with U.S. small value stocks underperforming the broad U.S. market by 3.69% and international small value trailing broad international markets by 0.69%.

Fixed income returns in the U.S. were negative in the fourth quarter as rates rose sharply over the quarter. The increase in rates was driven by expectations that the Fed would have to slow the pace of rate cuts in 2025 to combat sticky inflation.

WHILE HISTORY DOESN’T REPEAT ITSELF, IT OFTEN RHYMES

When the Federal Reserve began lowering the federal funds rate in September, it did so against a backdrop of moderating inflation and a cooling job market. Year over year, the Consumer Price Index (CPI) had declined from 3.5% in March to 2.6% by August, while over the same period, job growth slowed significantly—from a three-month average of 267,000 jobs to just 113,000.

Fast forward to today, and the picture has shifted. Year-over-year CPI ticked up slightly to 2.7% in November, suggesting inflationary pressures may not have fully subsided. Meanwhile, the labor market appears balanced, with the economy adding 212,000 jobs in November and 256,000 in December based on preliminary estimates. Layoffs remain below pre-pandemic levels, further signaling labor market stability.

As the chart shows, the current inflationary cycle bears striking similarities to the challenges the Fed faced in the 1970s. By lowering the target rate before inflation falls sustainably below its 2% goal, the Fed risks reigniting inflation, potentially necessitating even steeper rate hikes in the future.

At its most recent meeting, the Fed acknowledged the upside risks to inflation and responded by scaling back its projections for rate cuts in 2025 and 2026.

Looking ahead, policymakers emphasized that they are “not on a pre-set path” and that decisions “will depend on incoming data,” signaling a commitment to avoiding the policy missteps of prior Fed regimes.

U.S. ECONOMY POWERS FORWARD, FED POLICY BECOMES CLOUDY

Main Takeaway

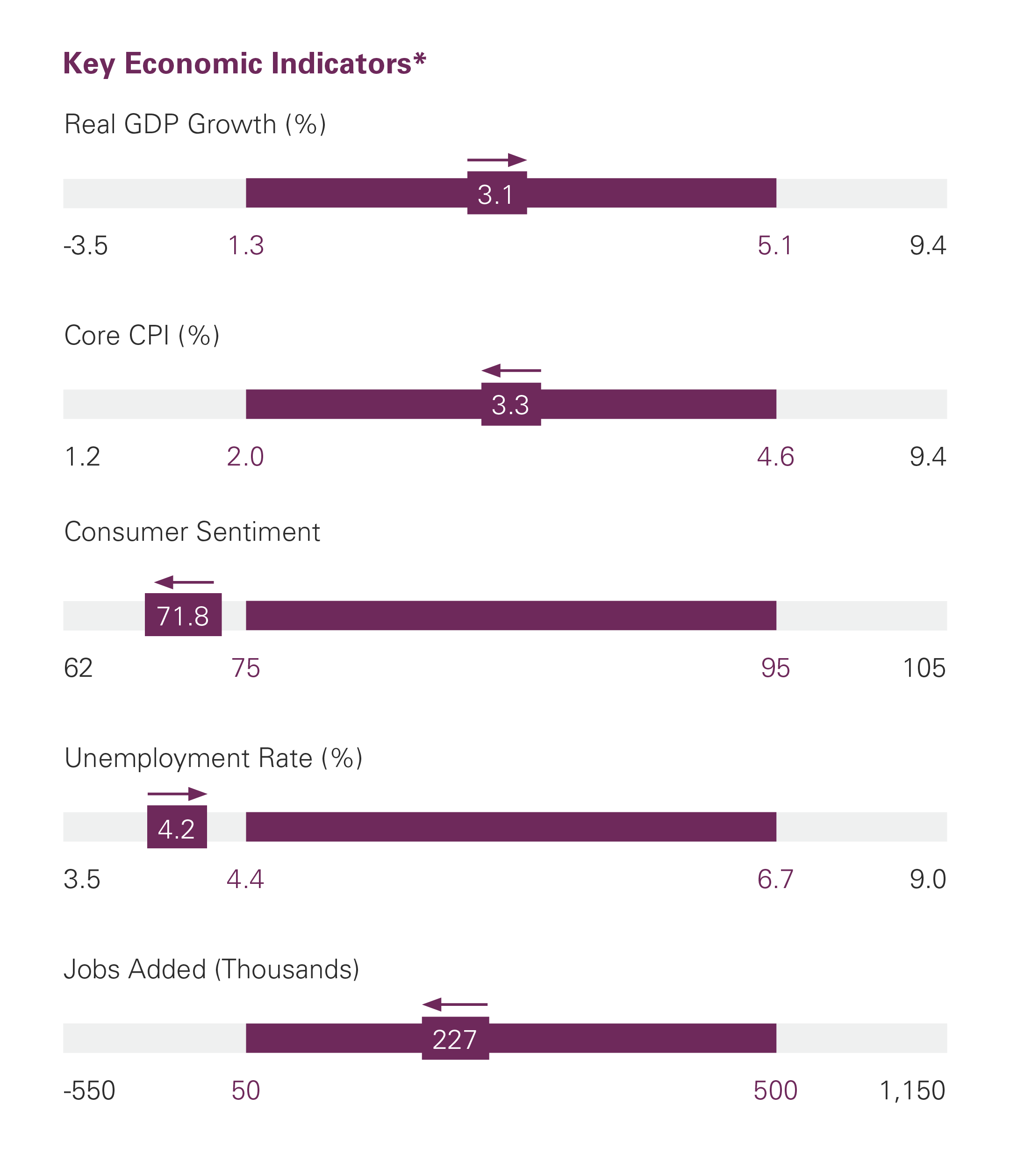

The U.S. economy continued on an impressive streak in 2024 with third quarter real GDP growth of 3.1% annualized. Growth outside the U.S. remains weak with third-quarter GDP growth in the eurozone and Japan coming in at 0.4% and 1.2% respectively. U.S. unemployment remains low, and job growth remains positive, although the pace of hiring has slowed this year. Inflation remains sticky in the U.S. as well as globally with the latest U.S. CPI reading at 2.7%, still above the Fed’s 2% target.

Top Risks

Aggressive tariff policies could increase price pressures while also having the potential to lead to a larger scale trade war, which could have significant negative impacts on global economic growth. In recent months, unemployment has been rising and cyclical areas of the economy (such as manufacturing and residential construction) have been softening. The U.S. federal debt continues to be a long-term concern with the potential to force interest rates higher for much longer, especially at the long end of the yield curve.

Sources of Stability

The U.S. economy remains strong and is unlikely to experience a major slowdown in 2025. U.S. household balance sheets remain strong, which has spurred robust consumer spending. The U.S. also continues to benefit from a surge in corporate and research spending on the back of artificial intelligence (AI). This “AI boom” has spurred massive investment into the development of AI itself as well as the infrastructure supporting it, including semiconductors, data centers, and energy infrastructure.

KEY ECONOMIC INDICATORS: AREAS TO WATCH

U.S. Economic Growth

The U.S. economy continues to show signs of strength with the Atlanta Fed forecasting fourth quarter real GDP growth at 3.2% (1), well above the Congressional Budget Office’s long-run growth estimate of 2%. Growth continues to be fueled by consumer spending, stimulative U.S. fiscal policy (such as the CHIPS Act and Inflation Reduction Act), as well as robust spending on AI, energy transitions, and data centers.

Inflation Trajectory

Inflation continues to hover above the Fed’s 2% target with recent reports showing a small re-acceleration. In November, CPI came in at 0.3%, or 2.7% year over year, up from 2.5% in August. Motor vehicle insurance and shelter costs remain two of the biggest drivers of inflation over the past 12 months, having risen 12.7% and 4.7% respectively. (2)

Monetary Policy

The Fed has continued the easing process by lowering the federal funds rate by 0.25% at both its Nov. 7 and Dec. 18 meetings, leaving the fed funds target rate in the range of 4.25%-4.50%. The most recent cut has been described as hawkish as the Fed sees risks that it will take until 2027 to bring inflation down to 2%, one year longer than anticipated in September. The Fed’s Dot Plot also showed the committee is expected to slow down the pace of future cuts with only two expected in both 2025 and 2026 and one cut in 2027.

Fiscal Policy

The U.S. Treasury Department’s year-end budget report showed a deficit of $1.8 trillion, or 6.4% of GDP. (3) Larger fiscal deficits coupled with higher interest rates mean the U.S. government now spends more on net interest expense than on defense. (4) Unfortunately, lowering the fiscal deficit is becoming increasingly more difficult as mandatory spending on entitlement programs like Medicare and Social Security has ballooned from roughly 30% of federal spending in the 1960s to 60% today. (5)

Labor Market

The labor market has slowed this year but appears to be stabilizing. The unemployment rate has held steady at 4.1%-4.2% over the past three months, coming in at 4.2% in November. (1) Job growth bounced back from a poor October, hampered by two major hurricanes as well as labor strikes, with 256,000 jobs added in December. Labor Department data shows that the quit rate increased slightly to 2.1% in October (2) but remains on a downward trend since 2022, a sign workers have become more pessimistic.

Consumer spending

Consumer spending remains robust at a 3.7% growth rate in the third quarter. The Conference Board’s Consumer Confidence Index hit 111.7 in November, a 2.1 point jump from October’s 109. (6) reading. The Board’s Expectations Index—which reflects consumers’ short-term outlook for income, business, and labor market conditions—rose to 92.3, well above the recession-signaling threshold of 80. Compared to October, consumers were substantially more optimistic about future job availability.

Global Economy

Global economic growth outside the U.S. has been slow with the eurozone, U.K., and Japan posting GDP growth of 0.4%, -0.1%, and 1.2% respectively. Inflation has also risen globally. In response, central bankers in the U.K. and Japan held off on rate cuts while the European Central Bank lowered its target rate 0.25% to 3.00%. Looking ahead, market participants expect the eurozone, U.K., and Japan to avoid recession, but growth prospects remain challenged.

Yield Curve

Despite the Fed lowering interest rates in the fourth quarter, we saw a large uptick in yields across the Treasury curve. Yields on 2-year, 10-year, and 30-year Treasuries rose 0.23%, 0.94%, and 0.74% respectively. Yield curves also steepened with the spread between the 2-year and 10-year Treasury widening by 0.16% to 0.25%. Rates were driven higher as the market digested the likelihood that the Fed would have to pull back on the pace of future rate cuts relative to their expectations in September.

Thanks to our reliance on long-term evidence-based investing principals, we know that short term data is too noisy to determine our investing choices. Yet, we always like to offer our review of markets because we believe this information should be accessible to all!