How to Calculate Your Taxable Income + Withholdings: Avoid Owing Tax or Getting a Refund!

2024 TAX FILING

With huge IRS layoffs, during the height of 2024 tax filing season, when the IRS department was already deeply underfunded and understaffed, filing this year could feel rough. With so much uncertainty ahead with the current administration, here are some things to keep in mind this tax season:

We encourage folks to file online using a PIN and make your payments digitally—don’t send a check that may not be deposited for awhile!

Refunds will probably take 3-4x as long, so be prepared and plan ahead if you need the cash flow.

Be kind to CPAs, accountants, and any folks working in this industry. An already tough job has become almost impossibly under-resourced. Practice patience.

File for an extension if needed but remember it’s an extension to file, not to make tax payments!.

Click below for all our 2025 reminders…

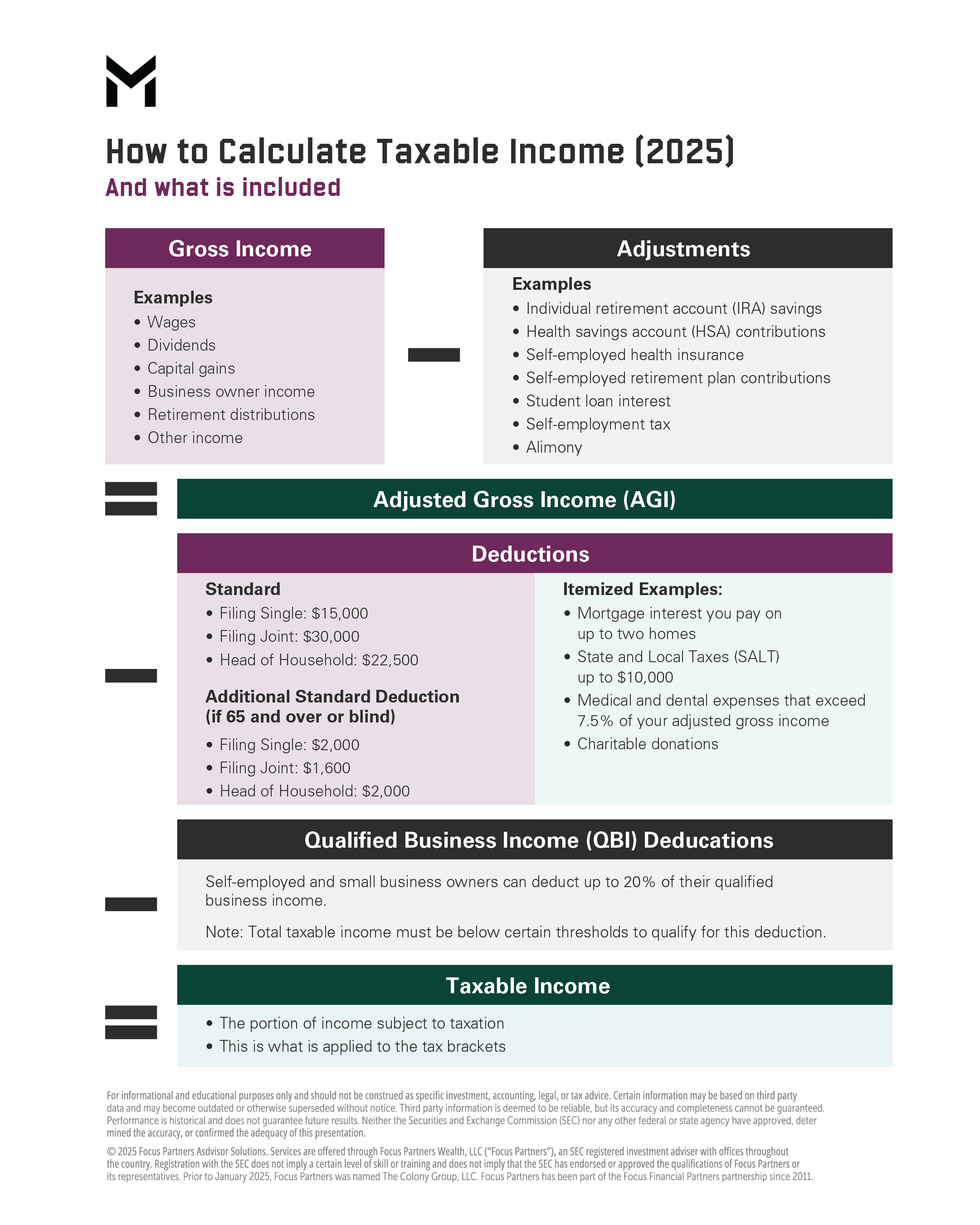

HOW TO CALCULATE YOUR TAXABLE INCOME

Understanding taxes can feel like a mystery and yet you can make a somewhat simple calculation to understand your taxable income.

Here’s our guide to calculating your taxable income.

Are Your Withholdings on Track?

You might hear people saying, “My refund was huge” or “I can’t believe I owed that much this year!” When we hear this, we think…taxpayers may need a reminder about why they received a refund or a big bill.

Basically, it comes down to how well you’ve estimated your income and adjusted your tax withholdings throughout the year. Sounds simple, right? Unfortunately, as with most things tax-related, there’s a maze of rules and withholding requirements to navigate. Let’s break it down.

Understanding Tax Withholdings

A century ago, U.S. taxpayers made one lump sum payment at year’s end. However, as incomes grew, the tax system evolved into a “pay-as-you-go” approach, requiring employers to withhold taxes from paychecks. This system makes it easier on the taxpayer to set aside income from each paycheck for both state and federal taxes.

However, your employer doesn’t pluck your withholdings out of thin air; instead, you’re required to withhold at least your safe harbor amount. This varies depending on your income taxes paid in the preceding year and your adjusted gross income (AGI).

To meet the safe harbor rule, taxpayers must withhold either of two options, whichever is less:

100% of last year’s tax liability (or 110% if income is over $160,000), or

90% of this year’s expected liability.

Many employers automatically withhold enough to meet these requirements, but mistakes can happen. It’s a good idea to check with HR to monitor withholdings, especially if you have additional income sources from outside business activities or a side hustle.

Your withholding amounts are also determined by allowances, which are essentially tax deductions that reduce how much is withheld. Factors like dependents, retirement contributions, mortgage interest, and charitable deductions can help reduce a taxpayer’s required tax withholding because their tax due is likely lower.

But I own a business, what do I do about taxes?

Estimated Tax Payments: What Business Owners Need to Know

While employees rely on withholding from paychecks, small business owners and self-employed individuals must make quarterly estimated payments to the IRS to ensure that they meet their safe harbor requirements. These payments should be made ratably throughout the year, meaning you should pay around 25% of your total tax liability each quarter.

Missing estimated payments or underpaying can result in significant penalties. The rules for estimated payments are similar to payroll withholdings:

Sole proprietorships, partners, and S Corp shareholders need to make quarterly estimated payments if they expect to owe more than $1,000 in a given year.

Corporations are required to make quarterly estimated payments if they are expected to owe at least $500.

These estimated payments are subject to the same rules as personal safe harbor amounts. That is, you must withhold either 100% of last year’s tax liability or 90% of this year’s expected tax liability.

For example, if you owed $10,000 in taxes last year from your sole proprietorship, you’d have to withhold $2,500 each quarter of this year. That means even if on January 2 you won a billion-dollar lottery jackpot, your minimum quarterly tax withholding would still be only $2,500 – at least until the following tax year!

Tax Planning Strategies for Business Owners

Understandably, many business owners don’t want to cut the IRS a check every few months to meet their mandatory withholdings. These funds could instead be better utilized back in the business. The good news is there are plenty of strategies to legally reduce your taxable income and, in turn, your required estimated payments:

Retirement plan contributions – Contributing to a SEP IRA, solo 401(k), defined benefit plan or other retirement plans can provide major tax savings.

Charitable contributions – Giving to charity can lower your taxable income, reducing your estimated tax bill.

Income deferral – Pushing income into the next tax year can help reduce your tax burden for the current year.

With prior planning, each of these mechanisms can reduce a business owner’s taxable income, freeing up cash flow. However, tapping into these tools might not make sense if they don’t fit your overall financial goals. Aligning your cash flow and spending with your long-term objectives is always the most important consideration.

Bottom line: Don’t let the tax tail wag the dog!

The Cost of Missing Payments: Penalties Explained

Failing to meet estimated tax payment deadlines can result in significant penalties. For payments due on January 15, 2025, the penalty is 7% of the underpaid amount. For example, a taxpayer who underpays their required estimated payment amount by $5,000 in January will owe an additional $350 in penalties (or $87.50 per quarter) when they file their annual return.

Taxpayers who have missed their quarterly estimated payments have a few options:

Pay the IRS what you owe – It’s painful, but it stops further penalties from accruing.

Withhold from a year-end bonus – If you’re an employee, ask your employer to withhold extra taxes from a year-end bonus.

Push income into the next year – If possible, delay receiving income, bonuses, or contracts until the new tax year to avoid an immediate tax bill.

Use an IRA distribution strategically – If you’re taking IRA distributions, withholding taxes from as you pull out cash can be an effective way to make up for missed estimated payments. Unlike estimated tax payments, withholdings are treated as if they were made evenly throughout the year, even if they happen in December. This means that taking a large IRA distribution that is completely withheld before year-end could help erase underpayment penalties.

Why You May Need a Tax Strategy Team

As the tax code becomes increasingly complex, keeping up to date with ever-changing legislation is difficult, and likely outside the scope of a business owner’s duties. Mistakes, even honest ones, can be extremely costly. This is where professional advice comes into play. Popular tax planning and reporting software often lacks the sophistication or nuance required to accurately identify, recommend, and implement multiyear tax strategies. These mistakes may lead business owners to withhold more of their income than needed, reducing free cash flow.

For those with high incomes and tax complexity, having both a Certified Financial Planner (CFP®) and a Certified Public Accountant (CPA) on your team can make a difference.

Your CFP will incorporate tax optimization strategies into your long-term financial plan while keeping up to date with legislative updates and new planning opportunities.

Your CPA’s primary focus is to ensure your taxes are filed accurately and timely.

Whether you’re an employee fine-tuning your withholdings or a business owner juggling estimated payments, proactive tax planning can save you time, money, and headaches. Having a professional team coordinate with each other is a fantastic way to make sure there are no gaps in your financial planning picture.