FROM OUR INVESTMENT COMMITTEE: Inflation May Have Peaked As New Year Begins

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

As the new year begins, markets have grown somewhat more optimistic that the Federal Reserve will successfully bring inflation down without causing a deep recession. However, risks remain, which could lead to sustained higher interest rates and more headwinds to stock and bond returns.

top risks:

The trajectory of inflation remains a big question. While economic data pointed to signs of prices slowing in fourth quarter, the housing shortage, tight labor market, reopening in China and overall energy markets pose risk to the Fed’s goal of cooling the economy by raising rates.

SOURCES OF STABILITY:

The global slowdown, along with the reopening of most economies, has reduced supply chain pressures, which should reduce inflation related to goods. Households still have some savings from pandemic-era payments, providing a buffer from higher prices. Bond yields have risen, providing better returns.

IN THE SPOTLIGHT:

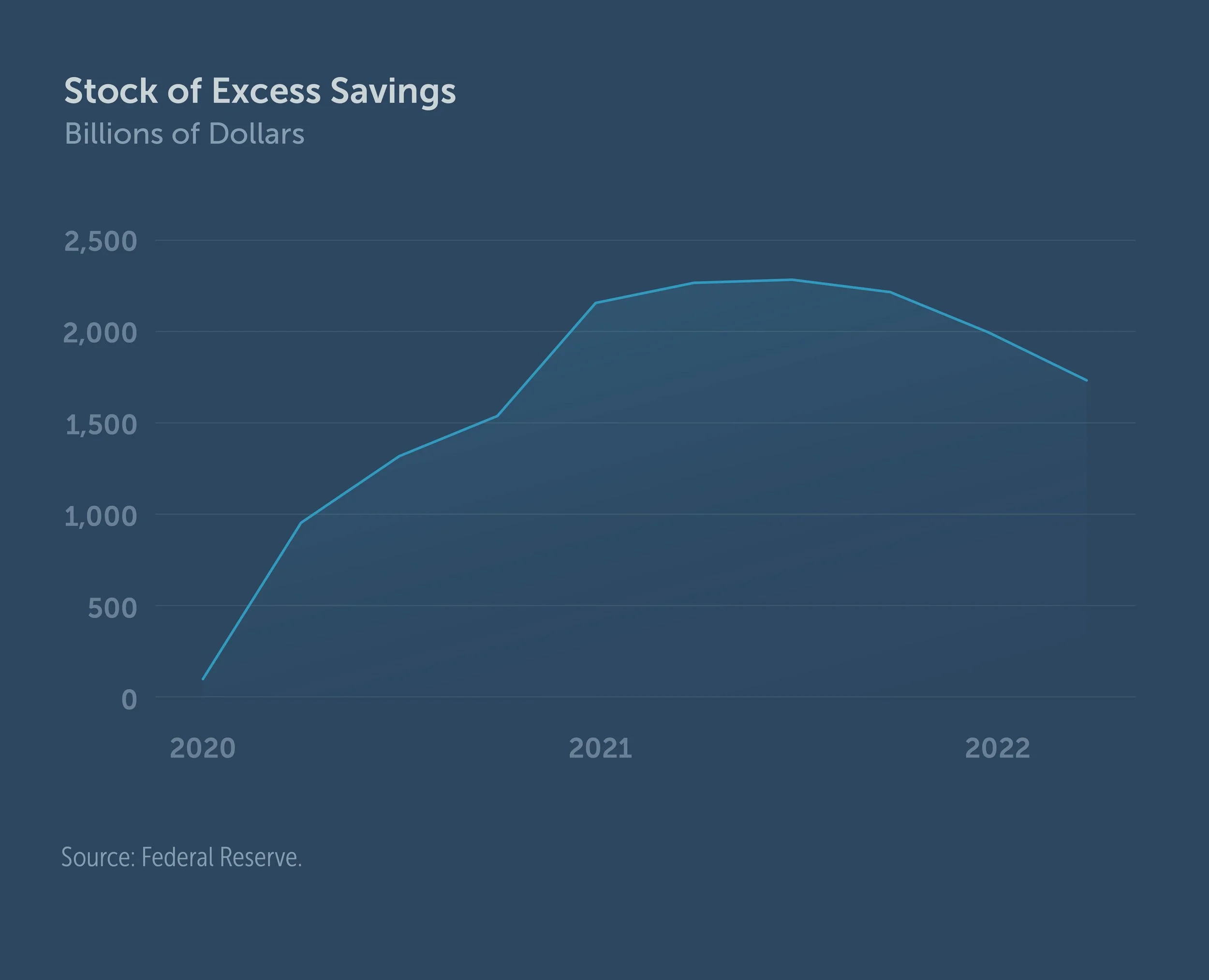

During the pandemic, consumers built up unprecedented savings thanks to government stimulus and fewer opportunities to spend. The extra cash helped households pay down debt, buy goods and take vacations once restrictions ended. In response, businesses raised prices and hired more workers to meet the demand. Economists estimate that households still have about $1.2 trillion to $1.8 trillion in excess savings, which has helped them maintain spending in the face of rising inflation and higher mortgage rates. Although the personal savings rate has since dropped to the lowest rate since 2005, the savings buffer should continue to help consumers in the short term if the economy slows or labor market begins to soften.

KEY AREAS TO WATCH

INFLATION AND INTEREST RATES

In December, inflation as measured by the consumer price index slowed to 6.5% annually, down from 7.1% in November. Signs of inflation moderating somewhat has been welcome news for the markets and consumers. In December, the Fed raised its benchmark rate by half a percentage point to between 4.25% and 4.5%. Although this increase was less than the series of three-quarter point hikes announced over the past year, the Fed indicated it expected to continue raising rates in 2023.

ENERGY PRICES

Although the price of oil has come down, diesel prices remain high, and any escalation in the war in Ukraine or a harsher winter could lead to spikes in energy prices. This in turn could raise the cost of goods. Green government policies and low demand for energy during the pandemic led to less investment in oil and gas operations and drilling, which resulted in a slower supply-side response during the latest energy crunch.

CHINA’S ECONOMY

With China’s announced plans to loosen its COVID-19 restrictions, many expect the economy to reopen fully in 2023. Because China is the second-largest economy, the resumption of pre-pandemic business and commerce there will increase global demand for energy, goods and services and could add to inflationary pressures. Alternatively, if China reverses course on reopening, or continues to experience a surge in cases, we could see less global demand, which may increase the risk of global recession.

STOCK AND BOND YIELDS

The Shiller Cape 10, a measure of average price-to-earnings (P/E) over the last 10 years, has fallen by about 25% over the year. The S&P 500 is now trading at roughly its long-term average P/E based on current earnings, meaning stocks are less expensive than a year ago. Bond yields are higher than last January and are providing a meaningful return. Although the yield curve remains inverted, which is typically an indicator of recession risk, investors may benefit from staying invested in short-to-intermediate term bonds of high quality.

HOUSING MARKET

The dramatic rise in mortgage rates is having an impact on the housing market. October marked the ninth consecutive month of declining home sales, and while the median existing home sales price was $379,100 in October, up 6.6% year-over-year, it was down 8.4% from a record $413,800 in June. While prices are slowing, higher mortgage rates increase the cost to borrow, and the housing affordability index has reached a 30-year low.

LABOR MARKET

We still see a shortage of labor with 10.5 million job openings at the end of November versus 5.7 million unemployed in December. Changing demographics and declining labor productivity will keep upward pressures on wages. Onshoring more jobs in the U.S. would increase the demand of U.S. labor, putting more upward pressure on wages, and thus, on inflation.

KEY ECONOMIC INDICATORS

where do the markets go from here?

Remember that it doesn’t matter to markets whether the news is good or bad, only whether it is better or worse than expected. At least for value stocks, the markets seem to be expecting almost the worst possible outcomes, as valuations are near levels reached at the depth of the great financial crisis.

Investing is about managing risks, not returns, and bear markets are a necessary low point in market cycles. Without bear markets, there would be no risk and no equity risk premium. Smart investors accept that uncertainty of economic and geopolitical risks is the norm and to be expected.

what are the investment planning implications?

Expect continued volatility: Investors should expect continued volatility in both stock and bond markets into 2023, especially around Fed announcement dates as the market interprets new guidance.

Review your allocation: With high-quality bonds providing more meaningful returns, investors should work with their advisor to ensure they have the right allocation to higher-risk stocks for both their plan and tolerance for portfolio declines.

Look beyond stocks and bonds: Some alternative asset classes continue to look attractive with performance that has been largely independent of the stock and bond markets. A small allocation to these strategies could cushion the portfolio during market declines.