What You Need To Know About The Current Market

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

The time has (finally) come.

We’ve felt a bit like a broken record or a party downer over the past six or so years. In all of our client meetings, we’ve talked about how, statistically, markets would eventually stop increasing. We’ve reminded our clients that markets will correct at some point. And that this correction is natural and to be expected. Since markets are cyclical, it would be very strange if it were summer and harvest all of the time. Winter will come, and then so will Spring, and eventually, markets would return.

Well, finally, what we’ve been reminding would happen has become a reality. The S&P 500 entered a bear market on January 3rd, 2022.

Let’s remember that the S&P 500 had a hyper fruitful run in just the past two years, averaging 16.26% in 2020, while last year in 2021, it produced a whopping 26.89%.

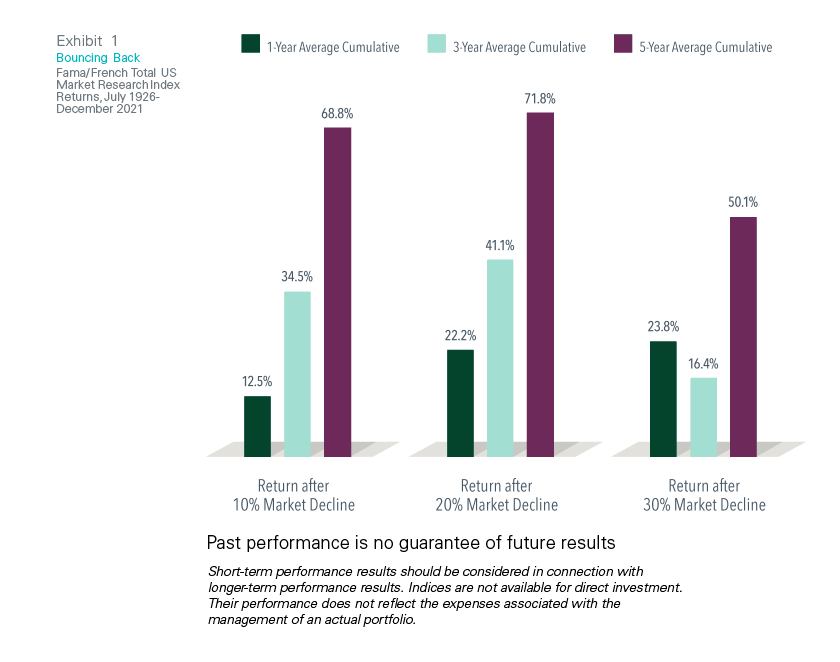

A look at the data makes a case for sticking with your investment plan. Handsome rebounds after steep declines can help put investors in position to capture the long-term benefits the markets offer.

History can Remind us of the bounce back

Historically, US equity returns following sharp declines have, on average, been positive. A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines.

On average, just one year after a market decline of 10%, stocks rebounded 12.5%, and a year after 20% and 30% declines, the cumulative returns topped 20%. Over three years, stocks bounced back more than 30% from declines of 10% and 20%, although—while still positive—returns were not as impressive after 30% declines. But five years after market declines of 10%, 20%, and 30%, the average cumulative returns all top 50%.

Understanding market cycles

It’s important to remember that returns in any given year may be sky-high, extremely poor, or somewhere in between. Yearly returns for S&P 500 have ranged as high as up 54% and as low as down 43%. At the end of the day, it all averaged out to ~10% returns.

Understanding the range of potential outcomes can help you stick with your plan while riding out the natural ups and downs in the market. This is why we tend to tune out short-term performance, especially when the time horizon for most retirement portfolios is 20+ years or even longer.

But, what Do i do?

For folks who are distributing cash for living expenses: a well-diversified portfolio with regular structural maintenance (like quarterly rebalancing) allows you to distribute from assets that aren’t experiencing as much turbulence (often lower volatility bonds). Meanwhile, the assets that are most impacted (often stocks in the US or abroad) can bounce around, minimizing impact to your distributions. When stocks start growing again, they take over to support distributions again.

For folks who are still accumulating: This turbulence means that stocks are now “on sale.” Generally, we recommend increasing contributions, if possible. Markets tend to recover over time, which means more growth for us over the long term! Just imagine that you’re buying on sale with each 401(k) contribution!

The best thing any of us can do is to tune out the noise, stick to your plan, and focus on what you can control: self-care, time with loved ones, and generosity towards those who are most impacted by economic inequality and uncertainty. Consider increasing your monthly donations to your local food bank, reproductive or civil rights organizations, or any other orgs working to make our communities more equitable.

MORE RECOMMENDED READING

Check out our blog post on The Importance of Sticking With It for more. And remember that when we take A Look at the Market In Relation To Crisis, we know that during periods of even significant geopolitical change, markets will price in new information quickly and tend to recover over time.