Research Brief: Markets in 2022

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

After a strong global rebound following the market downturn associated with the onset of the COVID-19 pandemic, both stock and bond markets have been incredibly volatile in 2022. This Research Brief from our Investment Committee reviews the factors that have impacted stock and bond market performance in 2022 and considerations as we look forward over the balance of this year and the longer term.

Inflation, Interest Rates, and the War in Europe

Toward the tail end of 2021 and into 2022, we saw U.S. headline inflation readings (the Consumer Price Index or “CPI”) come in at annual rates consistently above 6%, possibly peaking at an annual rate of 8.5% for the 12 months ending March 2022. The persistently high inflation rates with each passing month contradicted the Federal Reserve’s “high inflation is likely temporary” narrative, and as a result, it became clear that the Federal Reserve would need to increase its short-term interest rate, which is often cited as the “federal funds rate.”

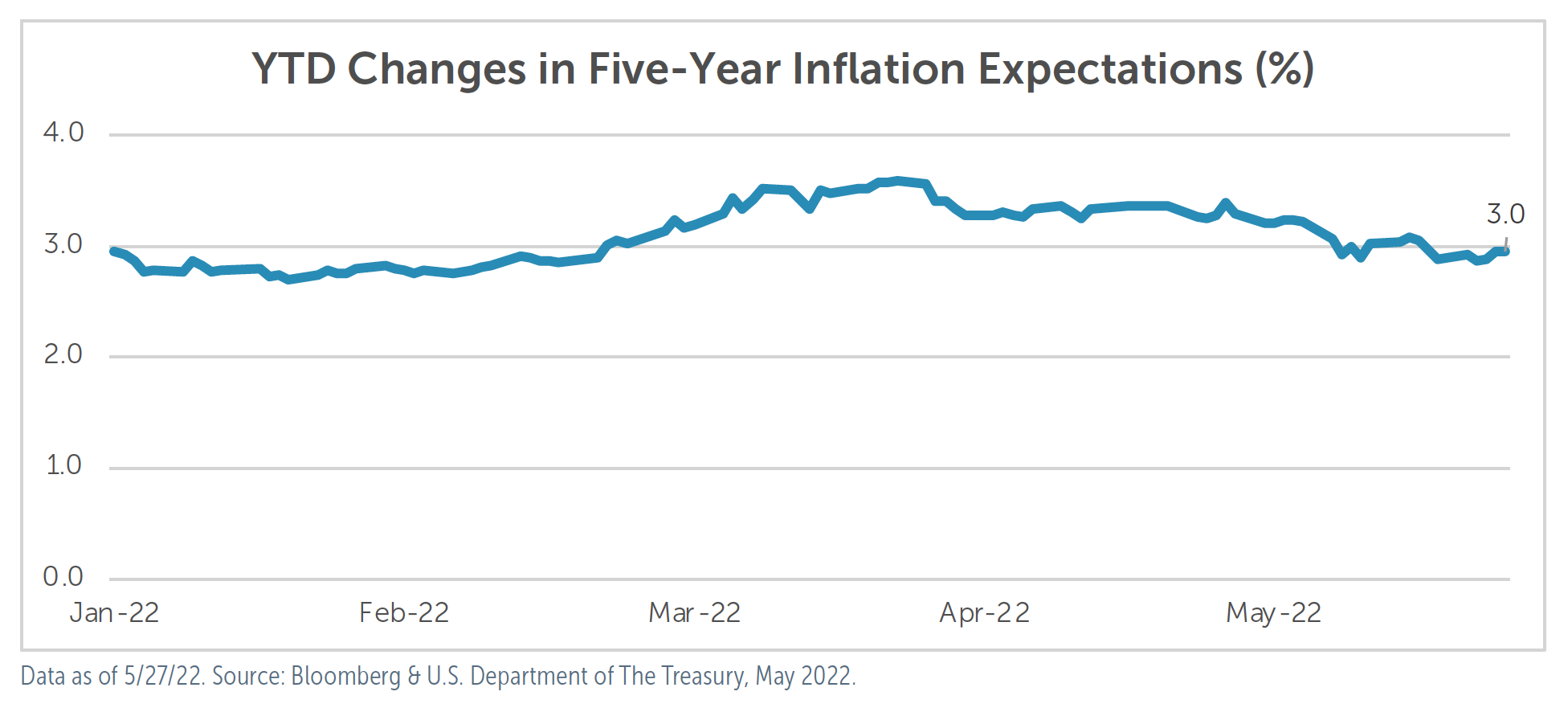

Because fixed income returns are generally negative when interest rates unexpectedly increase, most fixed income investments have generated negative returns on a year-to-date basis. Further, because global stock markets tend to perform poorly during periods of unexpectedly high inflation, global stock markets have also experienced negative year-to-date returns (see Figure 1 below). On top of this, war broke out in Europe with the Russian invasion of Ukraine. This certainly exacerbated market uncertainty alongside food and energy price inflation.

Looking Forward

During periods like the first half of this year, it is natural to be nervous about markets and question your financial plan, so we wanted to share points to keep in mind with a longterm, forward-looking perspective in mind:

The risk and return experience that most asset allocations have experienced so far in 2022 is within the downside risk that we plan for in the financial plans that we create for clients and in thinking about allocation recommendations before an allocation is implemented.

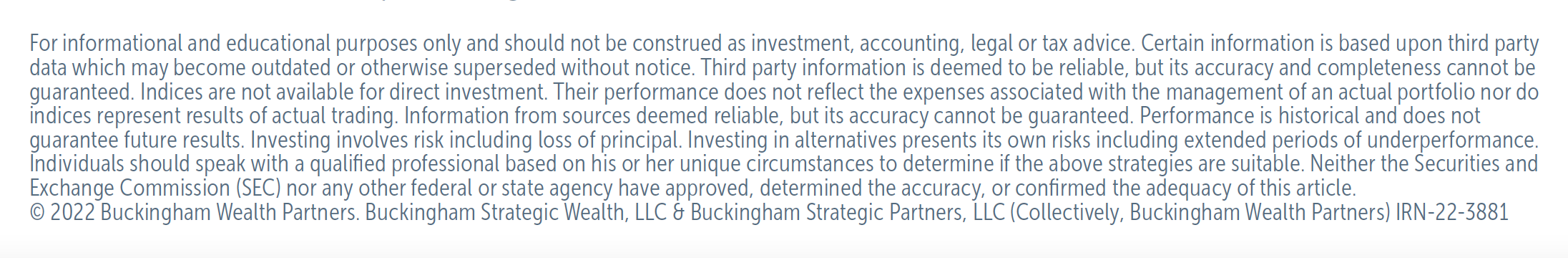

While inflation has been high, it is currently expected to moderate to more normal levels (see Figure 2 above), which shows how the market’s expectations for inflation have evolved throughout the course of the year). When we created the graphic, five-year inflation was expected to average 3.0% per year over the next five years. This is elevated relative to what had been the norm but well below what inflation rates have been.

While interest rates have increased substantially in 2022, it’s difficult to predict how interest rates will evolve from here. Markets are forward-looking, and one of the reasons rates have notably increased so far in 2022 is the expectation that the Federal Reserve will increase the federal funds rate significantly over the balance of 2022. In other words, interest rates, in general, have increased in advance of the Federal Reserve meaningfully increasing the federal funds rate.

For clients that have stock allocations “tilted” toward small-cap and value-oriented holdings, those allocations have generally performed better than broad stock markets showing the value of diversification across different types of stock holdings.

For stock funds held in taxable accounts, one way to soften the blow of negative market returns is to tax-loss harvest holdings, potentially allowing the losses that are realized to offset some portion of future gains.

For clients that are allocated to alternatives, most alternative strategies that we recommend (like real estate), when appropriate, have done significantly better than both broad stock and bond markets, providing much-needed diversification.