FROM OUR INVESTMENT COMMITTEE: Q4 2021 in Perspective

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

During the fourth quarter, global stock markets progressed upward as key indices set new all-time highs, reversing the trend from the previous quarter. Renewed COVID concerns related to the quick spread of the omicron variant caused worsening delays in air travel, business staffing shortages, and sparked concern among investors resulting in some short-term market volatility. In addition to tapering bond purchases, the Federal Reserve also announced the possibility of an accelerated timetable for multiple rate hikes in 2022 to combat rising inflation. These events and other factors nonetheless resulted in positive performance for domestic and international equity markets during the quarter.

For the quarter, U.S. stocks (as measured by the Russell 3000 Index) gained 9.3%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. Index) gained 3.1%. Emerging market stocks (as measured by the MSCI Emerging Markets IMI Index) lost 1.0%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased during the quarter—the U.S. dollar increased by 1.8% compared to foreign currencies. Over the past 12 months, the U.S. dollar increased by 6.7%. The increase in the dollar is a headwind (negative impact) to non-U.S. investments (like International and Emerging markets positions) held by U.S. investors for the last 12 months.

U.S. interest rates remained unchanged during the quarter as the Fed continues to maintain a target range of 0.0% to 0.25% for the federal funds rate. However, markets have currently priced in the expectation of three rate hikes during 2022.

U.S. Economic Review

The final reading for third-quarter annualized GDP growth of 2.3% showed continued economic expansion, albeit at a slower rate than previous quarters. The unemployment rate continues to shrink with a reading of 3.9% to end the quarter. Domestic inflation showed a reading of 4.7% in November 2021 as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE) index, remained above the Fed’s long-term target average of 2.0%. For comparison, the Consumer Price Index, which includes more volatile product groups like food and energy, showed a 6.9% reading for the period.

Financial Markets Review

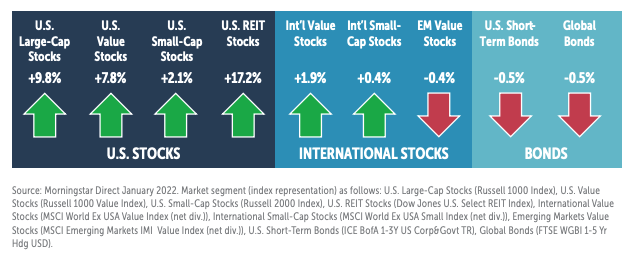

Domestically, large-cap stocks and REIT stocks posted positive performance for the quarter while only small-cap stocks were positive internationally. Value stocks receded globally. International stock returns were also impacted during the quarter by the strengthening U.S. dollar. During the quarter, U.S REITs were the best performing and emerging market value stocks were the worst performers. U.S. and global bonds were each up slightly during the quarter.

In the U.S., large-cap stocks outperformed small-cap stocks in all style categories. Value stocks outperformed growth stocks in all size categories except large-cap stocks. Among the nine style boxes, large-cap growth stocks performed the best and small-cap growth stocks had the lowest return during the quarter.

In developed international markets, large-cap stocks outperformed small-cap stocks in all style categories for the quarter. Growth stocks outperformed value stocks in all size categories except small-cap stocks. Among the nine style boxes, international large-cap growth stocks performed the best and international small-cap growth stocks experienced the smallest increase during the quarter.

Source: Morningstar Direct January 2022. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth, Mid: Russell Mid Cap, Value, and Growth, Small: Russell 2000, Value, and Growth).

Source: Morningstar Direct October 2021. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value, and Growth, Mid: MSCI World Ex USA Mid, Value, and Growth, Small: MSCI World Ex USA Small, Value, and Growth).

A diversified index mix of 60% stocks and 40% bonds would have gained 4.0% during the fourth quarter.