Our Advice: Stick To The Plan Despite Volatility

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

REMEMBER: IT’S A LONG GAME

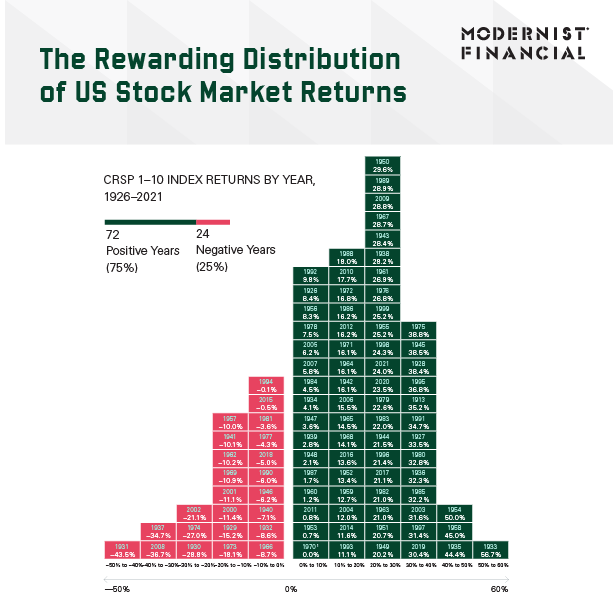

If you read Modernist’s blog, you know that we see tremendous value in sticking to your plan. The stock market can be unpredictable, and as this handy chart shows, it tends to reward investors who can weather the inevitable market ups and downs without abandoning the guidance of their financial plans.

If you’re finding market downturns unsettling, it may be reassuring to investors to remember that “Up” years have occurred much more frequently than “down” years in the U.S.

Some data to keep in mind when headlines seem to serve up an apocalyptic adjective with every market report.

The U.S. stock market posted positive returns in 75% of the calendar years from 1926 through 2021.

The market gained an annualized average of 10.2% during this period. Yet nearly two-thirds of yearly observations were at least 10 percentage points above or below the average.

More than two-thirds of the down years were followed by up years. The most recent example: a 5.0% loss in 2018 followed by a 30.4% gain in 2019.

Living through difficult markets is harder than observing them historically, which is one of the challenges of being a successful investor! We love the context this graphic provides:

recognize negativity bias

One thing we’ve been reminding our clients of recently is the prevalence of negativity bias, especially in the media. Fear and anxiety may sell the papers and get the clicks, but don’t always tell the full story. Data like what we’ve laid out above can help us counteract negative narratives about investing, by creating evidence-based context about how markets have performed historically.

Want to learn more? Here are some additional resources:

For other tips on countering negativity bias, check out 8 Science-Based Ways to Beat Negativity from Psychology Today.

A deeper dive into our investment strategy, including a look at recency and hindsight bias

We explore the question: is there a “right” time to invest?

We recently provided historical context to help understand the market in relation to global crisis

And the other side of the coin, when markets feel high: Fear of (Market) Heights? Don’t Panic