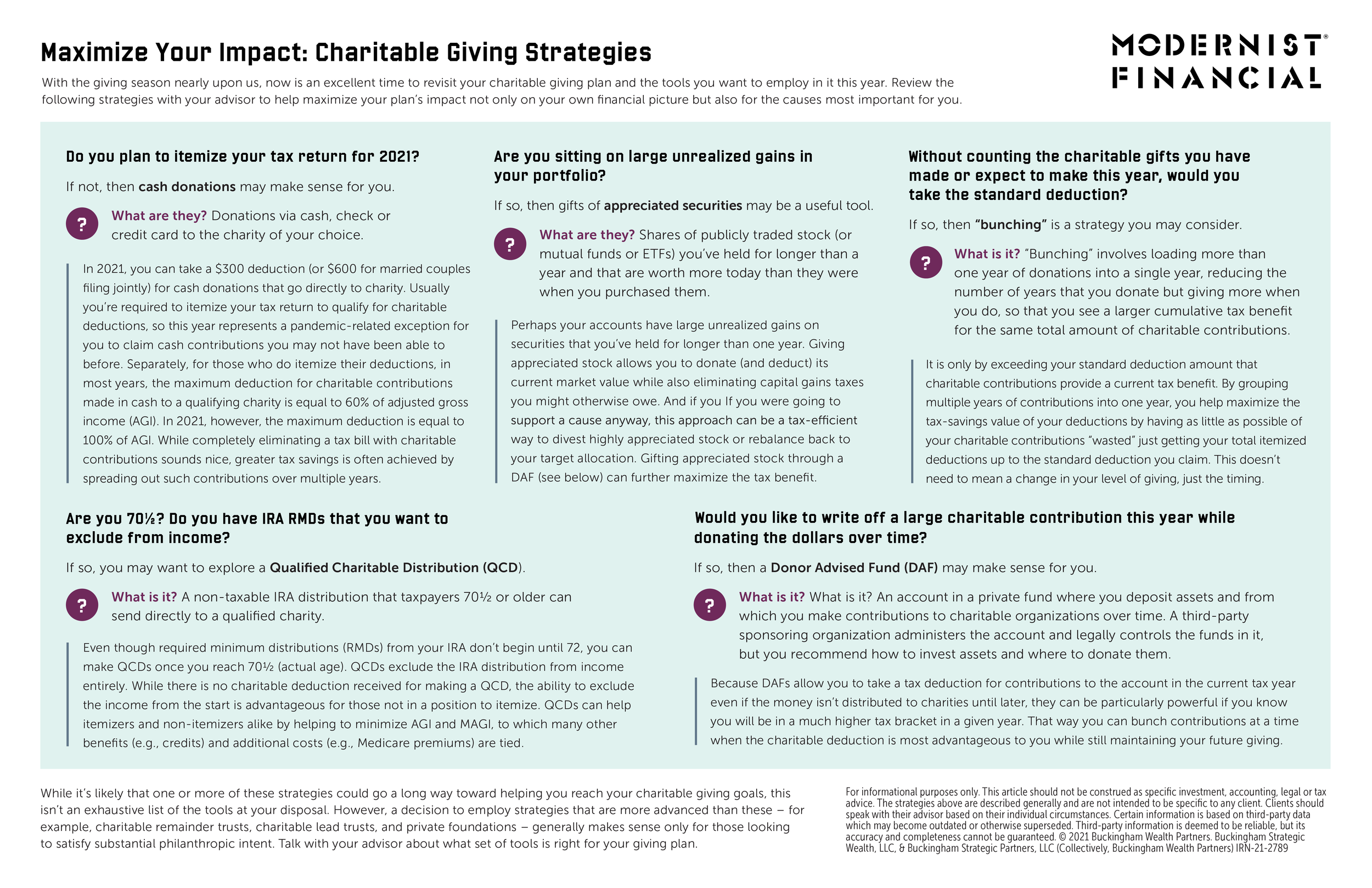

Maximize Your Impact: Charitable Giving Strategies

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

With the giving season upon us, now is an excellent time to revisit your charitable giving plan and the tools you want to employ in it this year. Check out the following strategies with your CPA or planner to help maximize your plan’s impact, not only on your own financial picture but also for the causes most important for you.

do you plan to itemize your tax return in 2021?

If not, then cash donations may make sense for you.

What are they? Donations via cash, check or credit card to the charity of your choice.

In 2021, you can take a $300 deduction (or $600 for married couples filing jointly) for cash donations that go directly to charity. Usually, you’re required to itemize your tax return to qualify for charitable deductions, so this year represents a pandemic-related exception for you to claim cash contributions you may not have been able to before. Separately, for those who do itemize their deductions, in most years, the maximum deduction for charitable contributions made in cash to a qualifying charity is equal to 60% of adjusted gross income (AGI). In 2021, however, the maximum deduction is equal to 100% of AGI. While completely eliminating a tax bill with charitable contributions sounds nice, greater tax savings is often achieved by spreading out such contributions over multiple years.

Are you sitting on large unrealized gains in your portfolio?

If so, then gifts of appreciated securities may be a useful tool.

What are they? Shares of publicly traded stock (or mutual funds or ETFs) you’ve held for longer than a year and that are worth more today than they were when you purchased them.

Perhaps your accounts have large unrealized gains on securities that you’ve held for longer than one year. Giving appreciated stock allows you to donate (and deduct) its current market value while also eliminating capital gains taxes you might otherwise owe. And if you If you were going to support a cause anyway, this approach can be a tax-efficient way to divest highly appreciated stock or rebalance back to your target allocation. Gifting appreciated stock through a DAF (see below) can further maximize the tax benefit.

Without counting the charitable gifts you have made or expect to make this year, would you take the standard deduction?

If so, then “bunching” is a strategy you may consider.

What is it? “Bunching” involves loading more than one year of donations into a single year, reducing the number of years that you donate but giving more when you do, so that you see a larger cumulative tax benefit for the same total amount of charitable contributions.

It is only by exceeding your standard deduction amount that charitable contributions provide a current tax benefit. By grouping multiple years of contributions into one year, you help maximize the tax-savings value of your deductions by having as little as possible of your charitable contributions “wasted” just getting your total itemized deductions up to the standard deduction you claim. This doesn’t need to mean a change in your level of giving, just the timing.

Are you 70+? Do you have IRA RMDs that you want to exclude from income?

If so, you may want to explore a Qualified Charitable Distribution (QCD).

What is it? A non-taxable IRA distribution that taxpayers 70.5 or older can send directly to a qualified charity.

Even though required minimum distributions (RMDs) from your IRA don’t begin until 72, you can make QCDs once you reach 701⁄2 (actual age). QCDs exclude the IRA distribution from income entirely. While there is no charitable deduction received for making a QCD, the ability to exclude the income from the start is advantageous for those not in a position to itemize. QCDs can help itemizers and non-itemizers alike by helping to minimize AGI and MAGI, to which many other benefits (e.g., credits) and additional costs (e.g., Medicare premiums) are tied.

Would you like to write off a large charitable contribution this year while donating the dollars over time?

If so, then a Donor Advised Fund (DAF) may make sense for you.

What is it? An account in a private fund where you deposit assets and from which you make contributions to charitable organizations over time. A third-party sponsoring organization administers the account and legally controls the funds in it, but you recommend how to invest assets and where to donate them.

Because DAFs allow you to take a tax deduction for contributions to the account in the current tax year even if the money isn’t distributed to charities until later, they can be particularly powerful if you know you will be in a much higher tax bracket in a given year. That way you can bunch contributions at a time when the charitable deduction is most advantageous to you while still maintaining your future giving.