Market Declines and the Long-Term Investor

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

The COVID-19 coronavirus sent stock markets and interest rates dramatically lower in the first quarter. As reports of the disease spreading outside of China grew, so did concern – panic at times – about what this meant for people’s health and broader, everyday lives. Governments and businesses stepped up preventative measures, but investors were concerned that the disruption would lead to an economic recession.Given the recent increase in market volatility and investor concern, we felt it would be beneficial to discuss how these events impact you, with three concepts that ring true during this market decline and any future declines.

You expected this.

While we don’t have a crystal ball and didn’t know the most recent decline would be caused by a viral outbreak, we do know that investments fluctuate based on new information. Investing in stocks, as opposed to more conservative investments, increases the likelihood of experiencing both more frequent and greater ups and downs. This fluctuation is what we get paid for, and history suggests that the greater the fluctuations of an investment, the greater the upside potential.

When investing in stocks, a good rule of thumb is to expect market declines of 3% to occur once per month, 5% declines to occur once per quarter, 10% declines to occur once every year, and declines of 20% or more to occur once a market cycle. This means your investment plan should incorporate the virtual certainty that you will experience many significant price declines over your investment lifetime. Thus, your equity allocation should reflect your ability, willingness or need to take risk.

The catalyst behind every market decline is usually different, as is the depth and duration of the decline. This is why we don’t recommend stocks for clients who need access to their money in the near future. We don’t want to have to sell stocks when they are down. And because your plan incorporates the certainty of such events, they come as less of a shock when they actually occur.

You have a plan.

The portfolios we build for our clients generally contain a mix of stocks, bonds and, possibly, alternative investments like real estate. When sudden market declines appear, the merits of our investment approach appear front and center. By including both U.S. and non-U.S. stocks along with bonds in a portfolio, we harness a variety of asset classes that react differently to new information.

The diversification benefits of our investment portfolios were on display in the first quarter. As we noted earlier, interest rates fell as news of the global impact of the virus spread. Interest rates fall because investors are buying more and more bonds, and that pushes up the price of the bonds we have in our portfolio. So, when our stocks were declining, our bonds were rising. This doesn’t happen to all bonds, but it historically has happened to the bonds that we prefer – shorter- to intermediate-term, higher-quality bonds. Additionally, non-U.S. stocks didn’t decline as much as U.S. stocks.

When markets decline, planning opportunities may present themselves (depending on each client’s unique situation). If the market decline causes a large enough imbalance in our portfolio, there may be an opportunity to rebalance our investments by taking some money from our bonds that have done well and investing that portion in stocks that have recently declined. Market declines and falling interest rates may also provide the opportunity to invest money that wasn’t previously invested, convert a traditional IRA to a Roth IRA, or even refinance debt. Following the plan lets us take advantage of these opportunities with a level head.

You invest with the odds.

We typically don’t like comparing investing to gambling, but we think there is an analogy that is too relevant to our investment philosophy to pass up.

Everyone knows that the massive, opulent casinos on the Las Vegas strip were not paid for by winners. Losing is a part of gambling. Given the size of the casinos, it makes sense that every game a casino offers has odds that favor the house. When it comes to investing, we choose to invest where we have the most favorable odds of success. And, just as a casino knows that some gamblers will go on long winning streaks, the overall odds still favor the casino, and, eventually, the casino gets that money back.

The market is the same, but long-term investors are the casino, so the odds are in our favor. We put the odds in our favor by investing in asset classes that historical evidence has shown will generate acceptable results. This includes our preference for small and value companies versus large and growth companies.

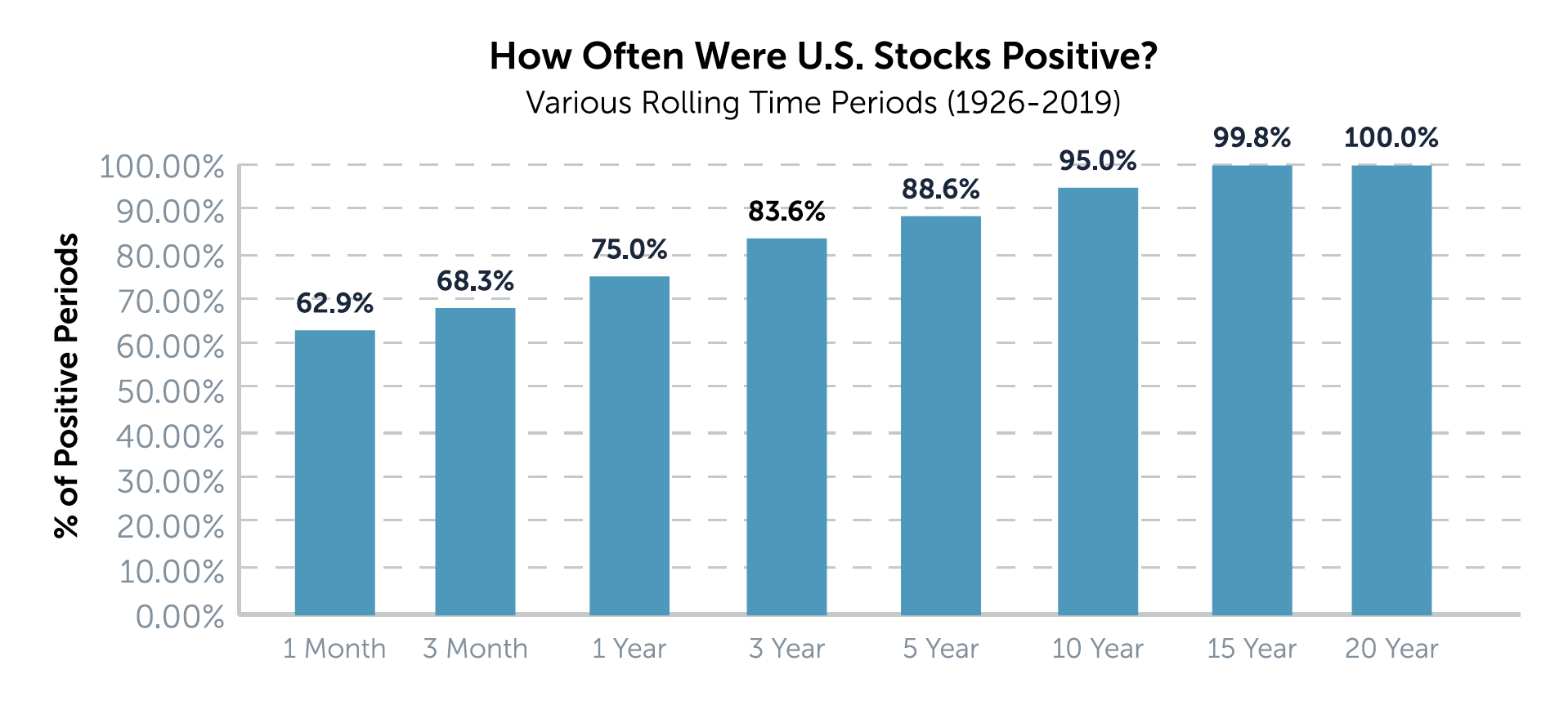

We also put the odds in our favor by investing for the long term. As we can see in the table, the longer we stayed invested in stocks, the better our odds of success.

While we don’t know when this bout of increased market volatility will dissipate, we have comfort in knowing that our investments were selected and built into a portfolio with this type of volatility in mind.

Markets have recovered from every decline like this in the past, so the odds are in our favor that we will recover this time as well. This is the true benefit of being a long-term investor. Not only can we weather the storm, but we typically come out better after it occurs.