FROM OUR INVESTMENT COMMITTEE | Q2 2018 IN PERSPECTIVE

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

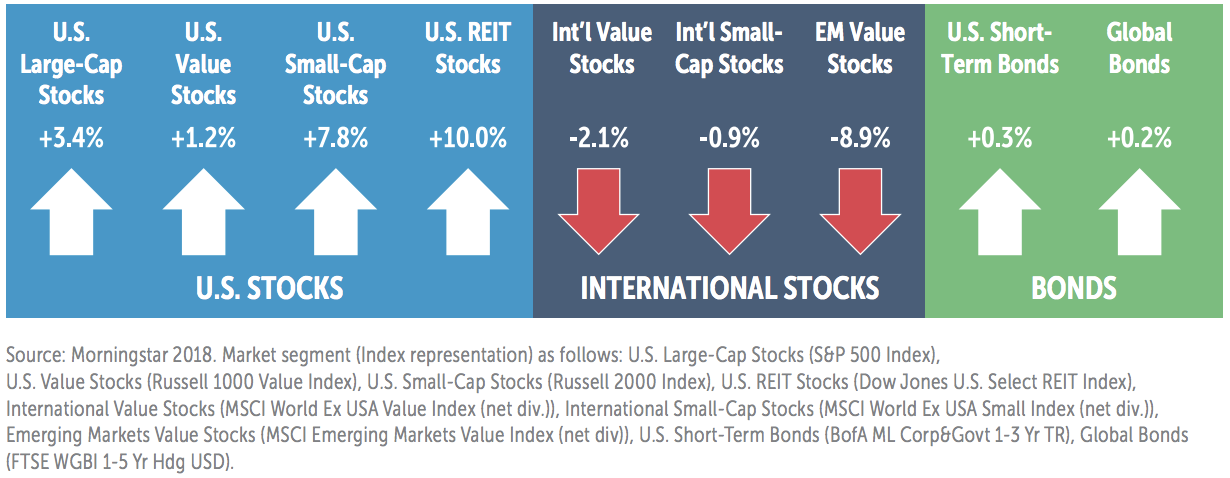

In a year where stocks should be basking in the light of corporate tax reform, healthy consumer spending, and an expanding global economy, investor returns are not what we would expect to see. For the quarter, U.S. stocks advanced, with the S&P 500 Index gaining 3.4%, while non-U.S. stocks declined. Emerging markets, as measured by MSCI Emerging Markets, declined -8.0%, and non-U.S. developed markets, as measured by MSCI World Ex US, declined -0.8%.

Despite robust earnings for U.S. companies during the first-quarter earnings season — the S&P 500 Index generated a massive 24.8% increase in earnings on a year-over-year basis — the escalating trade posturing between the U.S. and its major trading partners made investors nervous. The Trump administration continues to push its trading partners for more reciprocal trade relationships and is threatening tariffs on specific industries. These changes potentially impact the way some companies and countries do business, and therefore investors are concerned about what that means for stocks.

Interest rates were also a concern for investors in the second quarter. As anticipated, the Federal Reserve increased their key policy rate by 0.25% in June. The new benchmark target rate is 1.75-2.00%, and that is the seventh rate-hike since December 2015. Additionally, the Federal Reserve indicated that they are targeting two additional interest rate increases this year. For the quarter, the 2-Year Treasury rose 0.25% to 2.52%, while the 10-Year Treasury advanced 0.11% to end at 2.85%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, advanced in the second quarter — with the U.S. dollar appreciating by 4.3% compared to foreign currencies. Despite the second quarter gain, the U.S. dollar is weaker by -0.6% over the last 12 months.

U.S. Economic Review

Domestic economic data continued to show gradual improvement and growth. First quarter GDP increased at a 2.0% annual rate. The May 2018 reading of the unemployment rate fell to 3.8%, its lowest level since April 2000. The tighter labor market is finally starting to push wages higher as wages grew at a 2.7% pace for the 12-months ending in May 2018. The Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE) index, reached the Fed’s target of 2.0% in May 2018.

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg Economic Calendar, U.S. Department of the Treasury, Morningstar Direct 2018.

Financial Markets Review

U.S. small-cap stocks gained the most during a quarter where all the U.S. stock indexes we track posted positive results. International and emerging markets stock indexes all declined and the stronger U.S. dollar hurt returns for U.S. investors. Bond yields rose across the maturity curve during the quarter, with longer exposures like the Barclays U.S. Aggregate Bond Index posting a decline of -0.2%, while the short-term indexes we track posted small gains.

In the U.S., small-cap stocks outperformed large- and mid-cap stocks in all style categories. Among the nine style boxes, Small Value posted the largest gain of 8.3% for the quarter, and Large Value posted the smallest gain of 1.2% for the quarter.

Source: Morningstar Direct 2018. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth; Mid: Russell Mid Cap, Value, and Growth; Small: Russell 2000, Value, and Growth).

In developed international markets, stocks had mixed results. All size categories of Growth stocks posted positive gains for the quarter. Value and Core styles posted declines. International large-cap stocks outperformed or matched the performance of small-cap stocks.

A diversified index mix of 65% stocks and 35% bonds would have gained 0.95% during the first quarter.

Source: Morningstar Direct 2018. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value and Growth; Mid: MSCI World Ex USA Mid, Value, and Growth; Small: MSCI World Ex USA Small, Value, and Growth).